NeuroShell Trader - ZagTrader Edition

Overview

The NeuroShell Trader is trading system building software. It is not a trading system in its own right, it is a toolkit of both traditional and artificial intelligence (AI) techniques you can combine to form computerized trading models. The models can consist of indicators and rules like traders have used for years, artificial intelligence techniques, or hybrids of both. It will build models for equities, futures, commodities, options, FOREX, indexes and more.

You can build models for exchanges all over the world. To build models you just need to be able to obtain data for the instrument or exchange in which you are interest ed. Then the models you build will automatically back-test, and continue to give signals into the future as new data arrive.

Downloads

To order Neuroshell - ZagTrader edition, please contact us.If you already own a license of Neuroshell and wish to connect it to ZagTrader, download the latest bridge from here:

http://www.zagtrader.com/desktop/ZagTraderBridge1.22.msi

Current version: 1.12

File Size: 5.5MB

Advanced degrees and skills not necessary

To use NeuroShell you do not need to be a programmer, a Ph.D., an AI expert, a mathematician, or a statistician. In fact, sometimes it is better that you are NOT one of those things. That is because neural network experts, for example, frequently cannot come to grips with how easy and fast it is to train our neural networks. They are usually tied to the old style neural nets that require lots of "tweaking" to even get a net working. Often they think there must be something inferior about our technology because we have made it simple enough for traders and other novices to use. Neural net experts might be happier with our generic AI products.

Artificial intelligence study not required

Many people think they must have to read books about neural networks, genetic algorithms, and fuzzy logic or take a course before they can effectively utilize our software. That is just not true. We have already done all that studying for you starting in 1988, and created software that allows you to concentrate on the business end, not the science end. Our genetic algorithms, for example, act almost like other traditional optimizers. The main difference is you don't have to give them search increments, because they don't search the same way. With our advanced neural nets, you mainly worry about what to feed them, instead of how to get them configured and running. We let you drive with an automatic transmission, power windows, power steering, and power seats instead of making you learn to shift gears and do everything else manually.

Not a "silver bullet"

Although we have made artificial intelligence easier to use, it does not instantly build wonderful trading systems. However, we do provide a number of examples and other traditional systems designed by others.

Four versions

The NeuroShell Trader comes in four versions:

The NeuroShell Trader Professional uses only daily, weekly or monthly bars and contains over 800 indicators. It also includes neural networks, the genetic algorithm optimizer and advanced indicators like wavelets, principal component analysis, and fast Fourier transforms. It contains an Indicator Wizard, a Prediction Wizard and a Trading Strategy Wizard. It has the capability of saving templates for indicators, predictions, and trading strategies. You can define alerts to let you know when conditions you define have occurred. In this version, you can also call indicators you have programmed, should you choose to do so.

The NeuroShell DayTrader Professional is like the NeuroShell Trader Professional, except that it reads and displays intraday (real time) data bars. There are also some additional indicators to define time based events. For example you can specify you only want to trade between 10 am and 11 am. You can choose from hour and minute bars, and on some data feeds, you can use second, volume and range bars.

The NeuroShell Trader Power User includes all of the features of the NeuroShell Trader Professional plus features designed for enhanced flexibility in creating winning trading models. You can include multiple timeframes in the same chart: daily, weekly, and monthly versions of any data stream, indicator, prediction, and trading strategy as well as other instrument data. You can choose from 14 different Position Sizing methods to determine how many shares, contracts, or units to buy with each trade, or let the optimizer assist in the process. The pyramiding/scaling options add the ability to either enter or exit trades with more than one order, again with assistance from the optimizer if you choose. If you want to evaluate your model’s performance on a Trading Strategy that is re-optimized regularly on newer data, and then applied to out-of-sample data, you can use the Walk-forward Optimization feature. The Power User versions add the ability to optimize and backtest multiple trading strategy templates on multiple instruments in one continuous process.

The NeuroShell DayTrader Power User includes all of the features of the NeuroShell DayTrader Professional AND the NeuroShell Trader Power User versions. In addition to the multiple timeframes that are part of the NeuroShell Trader Power User version, you can add hour and minute bars, and on some data feeds, you can use second, volume and range bars.

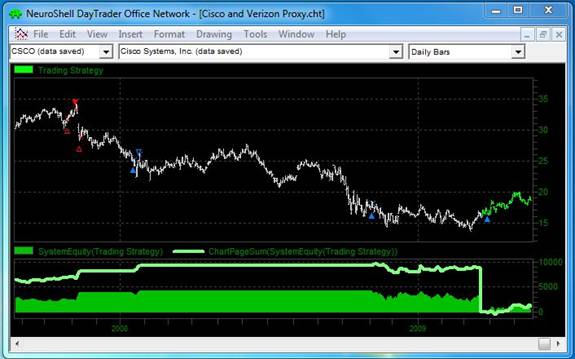

Everything is chart based

Charts are the major component of NeuroShell. You may open many charts at one time, either new ones or ones you have previously built and saved. When you create a new chart, you specify their periodicity with which you want to see and process the data, as well as how far back in time you want to load the data. Next you specify the related instruments whose historical data should be loaded into the chart. They are the target instruments for which you wish to create trading signals. Multiple instruments in the chart show up in their own chart page. For the rest of the discussion in this document, let's say you load EMAAR, IBM, DELL, HPQ, and AAPL as your target instruments. (They don't have to be stocks; they can be FOREX pairs, commodities, E-minis, options, etc).

Data streams

Charts contain data streams, which can be plotted or hidden. Of course, the first data streams loaded will be open, high, low, close, volume, and possibly more raw data for the target instruments. You can also insert other data streams called other instrument data that will be available in each chart page, like indexes or raw data for other stocks or commodities. This other instrument data is information you want to use to create trading signals. For discussion, let's say you believe that the EURO/CAD currency pair and the price of gold will be useful for deciding how the target Forex pair should be traded. You would then load these as other instrument data so that they will be available data streams in all chart pages.

Indicators

The next data streams you will want to include will probably be indicators. Models generally are built using indicators based upon the raw data and the other instrument data. Let's say you believe that the following indicators will be useful in models that will produce trading signals, because you have heard people in your investment club talking about them:

- The spread% between each AUD/CAD and EUR/CAD

- A stochastic %k indicator applied to Forex pair

Therefore, the next thing you might do is insert the indicators above into your chart using the Indicator Wizard.

You may or may not have a clue about what the indicators above do - read on.

Models

Once the chart loads up with the requested data, you are ready to define one or more models in the chart. Any model that you build in the chart automatically applies to all instruments in the chart. Your model can be optimized the same for all chart pages, or custom optimized for each chart page. Models can be either Trading Strategies or Predictions.

You may or may not have a clue about how the indicators you have chosen work. If you do, you probably have some idea about how they would be used to generate trading signals, rules like "Buy when the spread% between the AUD/CAD and the EUR/CAD is high, and sell when the spread% is low." In this case you will want your model(s) to be Trading Strategies, even if you are unsure what values should be considered high and low above. The genetic algorithm optimizer will find the values for you, or alternatively, you might just want to use our Fuzzy Sets add-on.

If you either have no clue about how the indicators work, or no clue about appropriate rules for them, you will probably want to build a Prediction with a neural net for your model(s), because neural nets find their own rules.

Note that you can insert several models in a chart. Once you insert a model, it automatically applies to all chart pages.

Trading Strategies

The Trading Strategy Wizard is a fast mechanism for entering trading rules without having to type messy formulas or write in some algorithmic programming-like language. The Wizard is all point and click. You just list the rules for long entry, long exit, short entry, and short exit (cover). Each of these rules is in fact an indicator you build just like any other indicator - with the Indicator Wizard. You can also enter indicators for stop and limit price levels, including trailing stops.

If you want to optimize your trading strategies, the genetic algorithm optimizer will do these things for you:

- Find which of the rules you have listed should be used in combination

- Find out what the parameters of the indicators in your rules should be set to

- Perform 1. and 2. above at the same time (we call this full optimization)

Even your stops and limits can be optimized.

When the Trading strategy is complete, it will show you historical buy and sell signals. As new data is entered into the future, those buy and sell signals will continue to appear with each new bar. You can insert a variety of indicators to plot how your profit is growing.

Predictions

Predictions are neural nets made with the Prediction Wizard. That's what our standard neural nets do, they make predictions about the future value of a data stream, usually a price or change in price, but any data stream can be predicted.

Here is basically all you have to do to make a prediction model:

- Choose some inputs - data streams, usually indicators, that you believe are leading indicators of the market

- Decide what you want to predict, usually change or percent change of the open or close

- Decide how much historical data will be used to train the neural net

- Decide how much historical data you want to use to test how well the neural net has learned

If you want to optimize your prediction, the genetic algorithm optimizer will do these things for you:

- Find which of the inputs you have listed should be used in combination

- Find out what the parameters of the indicators in your inputs should be set to

- Perform 1. and 2. above at the same time (we call this full optimization)

- Find neural network thresholds for trading

When the prediction is complete, it will show you historical buy and sell signals. As new data arrive in the future, those buy and sell signals will continue to appear with each new bar. You can insert a variety of indicators to plot how your profit is growing.

Back-testing

Sometimes when you build traditional models, neural net models, or optimized models of any type, it is possible to make a model so good that it does not hold up with future market conditions. This is called over-fitting. Therefore, NeuroShell contains facilities that will automatically backtest with out-of-sample data for you, so you can gain confidence that your model will hold up in the future.

Our optimizer also works in a mode we call "paper trading". In this mode, the optimizer keeps the model that works better in a period of time after the optimization period, rather than the optimal (peak) model. Paper trading automatically gives you a model that is less likely to be overfit, and more likely to work well into the future.

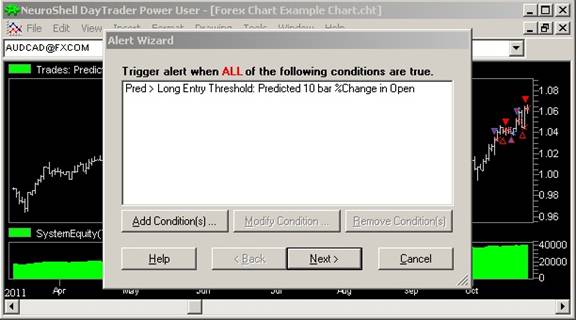

Alerts

NeuroShell lets you take almost any condition, not just trading signals, and define an alert to let you know when that condition has just occurred.

Integrated trading

Once you have developed a model that you are happy with, you can specify that trades be sent to your account at ZagTrader for execution, with the fill price being returned to NeuroShell. The trades can be sent automatically, or only after you approve them. As an alternative, NeuroShell will email your trades to email addresses of your choice.

Endless possibilities for advanced users

Since everything in NeuroShell is a data stream, there are many ways to build hybrid models by feeding the results of one wizard into another wizard. Indicators can go into other indicators, predictions and trading rules can go into indicators, trading signals can go into other trading rules, etc., etc., etc.

You can build hybrid trading strategies that involve neural net predictions as well as standard rules. You can build a "panel of experts" - a strategy that consults several other strategies or nets to see what the majority predicts.

You can build pairs trading models and even optimize them.

You can build portfolio models, where the model looks at a basket of stocks and takes a position in one or more of them based upon their relative position in the basket (Relative position can be based upon one or more indicators or neural nets.) These portfolio models can be hedged to be market neutral, so that at a given time there are an equal number of long and short positions.

You can build intraday models with the NeuroShell DayTrader Professional to make decisions about direction of the market at specified times of the day.

You can optimize each instrument in the chart individually, or do one general optimization that results in the same model for all instruments in the chart.

You can export data, indicators, signals, equity curves, etc. from NeuroShell into text files for processing in Excel, statistical programs, or other trading systems. You can load text files of indicators or signals from other programs into NeuroShell in many cases.

Sometimes you may have in mind indicators that are too complex even for our Indicator Wizard to construct. In that case, you can program your own in standard languages.

Chrome wheels and leather seats

You don't need to purchase any other software to be successful with NeuroShell. However, we and other companies offer add-ons to enhance or add other features to NeuroShell. These are for people who want and can afford more "toys". Our offerings include different forms of adaptive neural networks and fuzzy logic add-ons. Take a look at our Pattern Matcher add-on.

Tools for learning the software

Although we have made the artificial intelligence easy to use, there is nevertheless a lot to learn about our very comprehensive software. Here is what we offer currently at no charge:

- Videos to get you started

- A complete set of examples to show you how to use all of the important features

- Comprehensive, context sensitive help file

- Tech support web site with tips and techniques

- Discussion forum

- Models that we built to correspond to articles in Technical Analysis of Stocks and Commodities Magazine.

Why you should choose NeuroShell

We are often asked how we compare with other trading software. Frankly, we don't have the time to keep up with what everyone else is doing, but we have compiled a list of some common sense reasons why we think you should own NeuroShell as opposed to purchasing some other system.

More information

We welcome and encourage your calls by phone or Skype to our highly technical sales department. However, we realize that some people may be reluctant to take that step. So why don't you email us with your questions? If you just want to read more, there have been a number of news stories about NeuroShell and AI in the past, as well as reviews of our products.

License

NeuroShell is licensed for use on only one computer at a time. You may install it on multiple computers, but you must "deactivate" on one computer before you "reactivate" on another. Activation and deactivation takes only a few seconds while your computer communicates to our database. You would do this if, for example, you wanted to run NeuroShell both at home and at your office, and again on your laptop when you take a trip. At the time you activate and deactivate, however, you must be connected to the Internet, and be able to turn off your firewall or otherwise allow NeuroShell to get through it. If not, you will be limited to one computer.