ZagTrader Central Securities Depository System (CSDS)

A Central Depository is a financial institution that holds securities on behalf of its clients and facilitates the transfer of ownership of those securities. Central Depositories play a critical role in the financial industry by providing safe and efficient custody and settlement of securities.

Central Depository software is used to manage the secure storage and transfer of securities, as well as to track ownership and facilitate the settlement of trades. This software typically includes features such as:

- Record-keeping: This is the core function of Central Depository software, which maintains a record of who owns what securities at any given time. This feature may be connected to the settlement feature, which transfers ownership of securities between parties, and the corporate actions feature, which updates ownership records in response to corporate actions such as stock splits or dividends.

- Transfer of ownership: Central Depository software systems facilitate the transfer of ownership of securities from one party to another, including the updating of records to reflect the new ownership.

- Corporate actions: Central Depository software systems help to manage the process of corporate actions, such as dividends, stock splits, and mergers, and ensure that the appropriate actions are taken on behalf of the securities holders.

- Security: Central Depository software is designed to ensure the security and confidentiality of ownership records and financial transactions. This feature may be connected to the user management feature, which controls access to sensitive financial information, and the reporting feature, which generates reports on ownership, trades, and other financial transactions for use by market participants and regulatory agencies.

- Reporting: Central Depository software systems generate reports to help clients track their securities holdings and transactions.

- Integration with external systems: Central Depository software may be integrated with other financial systems, such as trading platforms and clearinghouses, to facilitate the smooth flow of information and facilitate the settlement of trades. This feature may be connected to the settlement feature, which relies on accurate and timely information from external systems to facilitate the transfer of ownership.

- User management: The software includes tools for managing user access and permissions.

- Data backup and recovery: The software includes measures to protect against data loss and facilitate recovery in the event of a system failure.

Transfer of Ownership

Corporate Actions

Security

Reporting

Facilitating cross-border investment flows

Settlement cycle

Full Margin Module

Linkage between Cash & Securities Settlement

Delivery Versus Payment (CVP)

Corporate Actions

Multi-batch settlement

Risk Management

Swift integration

Custom XML - XBRL Reporting Templates

Customizable

Fully Scalable & updated version

Central Depository software systems play a vital role in the financial industry by helping to ensure the accurate and efficient management of securities and the transfer of ownership. They help to increase transparency and reduce risk in the settlement process.

Key Feature

- Flexible settlement cycles that range from T+0 to T+5 on negotiated deals.

- Introduce a new range of products aligned with international best practices.

- Integration and linkage with ICSD via API or FIX.

- Dynamic reporting with the option to develop new reports used for public disclosures in XML – XBRL.

- Fully scalable software upgraded with up-to-date Technologies for use in core CSD functions/processes.

ZagTrader supports SWIFT for central securities depositories

Streamlining communication between CSDs and their counterparties

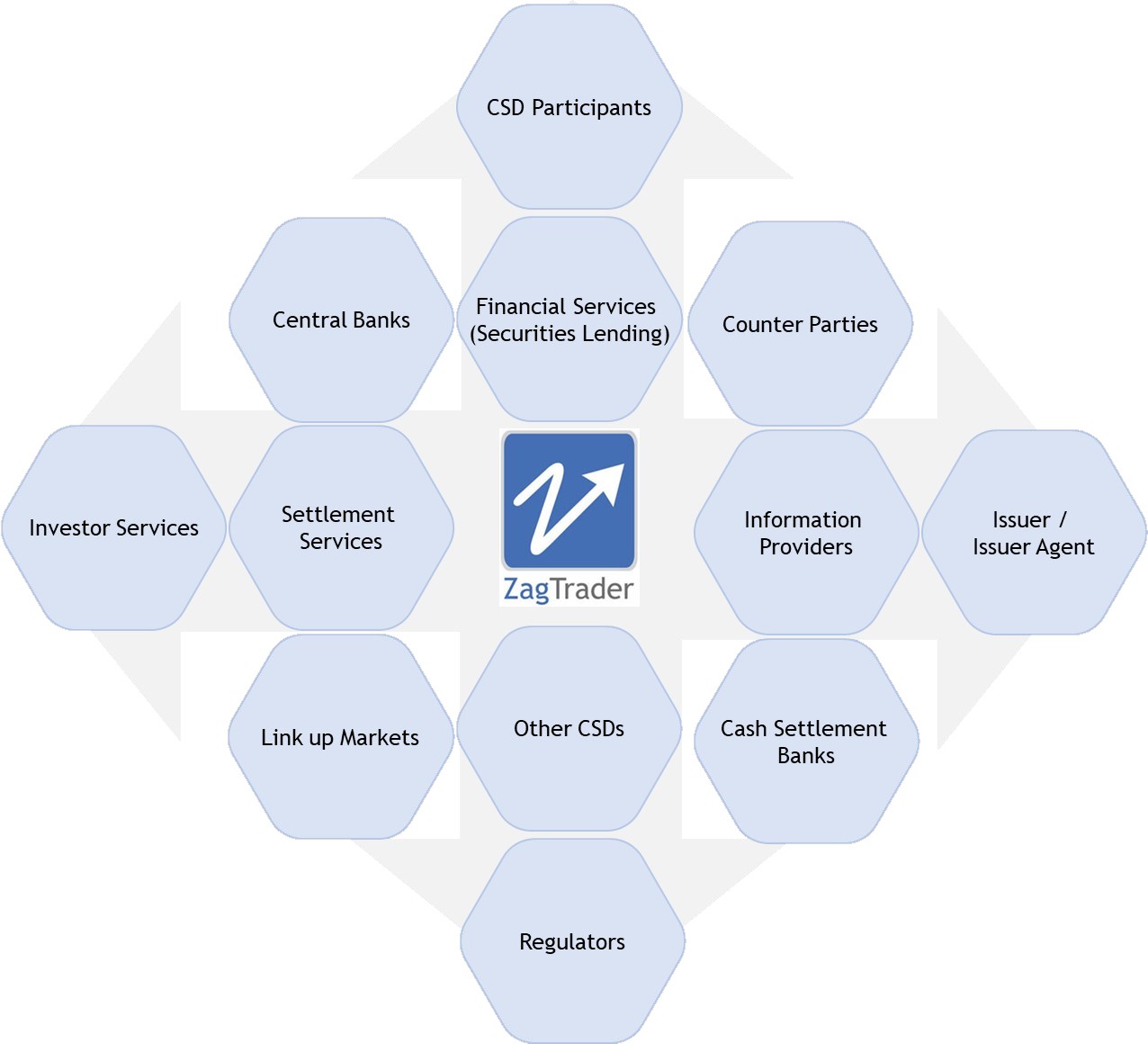

SWIFT offers central securities depositories (CSDs) a complete and proven solution for standardised communication with all their domestic and cross-border counterparties – including their participants, stock exchanges, clearing houses, other CSDs, central banks and regulators. CSDs use SWIFT as a highly secure and resilient channel to support the growing number of interactions they have with their counterparties. Using SWIFT enables CSDs to comply with regulations and industry recommendations, leveraging global industry standards and best practices to improve operational efficiency and benefit from economies of scale.

Supported SWIFT Message Type References :

- Customer Payments and Cheques

- Financial Institution Transfers

- Treasury Markets: Foreign Exchange and Derivatives

- Collections and Cash Letters

- Securities Markets

- Treasury Markets: Precious Metals and Syndications.

- Documentary Credits and Guarantees

- Travellers Cheques

- Cash Management and Customer Status

- Common Group Messages

Clearing: Clearing houses/Central counterparties

CSDs interact with clearing houses/central counterparties (CCPs) for several reasons.

- Receiving from clearing house/CCPs clearing participants settlement obligations (gross or netted instructions) — Sending to clearing houses/CCPs settlement fails notifications, leading to potential buy-in procedures.

- Sending to clearing houses/CCPs information about securities pledged by clearing participants as collateral for their clearing obligations.

- Sending to clearing houses/CCPs information about corporate actions impacting the holdings they have in their account as collateral – or impacting unsettled instructions All of these interactions between CSDs and clearing houses or CCPs can be carried out over SWIFT.

These include:

Cash transactions: Central banks, Target2 (T2) and correspondent banks

CSDs need to communicate with central banks, T2 (for Europe) and correspondent banks for a range of purposes.

- Sending cash payment instructions to settle the cash leg of delivery versus payment (DvP) transactions.

- Receiving formal confirmation of cash availability or receiving confirmation of the actual cash debit.

- Confirming to a central bank that collateral has been moved to its account – or has been pledged to it – so the central bank can extend credit lines to a participant for cash management purposes.

These include:

All of these communications can be conducted over SWIFT.

Securities transactions: Other CSDs, Link Up Markets and Target2Securities (T2S)

- The exchange of settlement instructions and confirmations with other CSDs, if the local market uses the local CSD for the settlement of foreign listings on the local exchange.

- Linkages with external providers of centralised settlement functions and shared infrastructures for value-added service.

- SWIFT can support all these interactions.

Issuance: Issuers and information providers

To support their issuance and information services, CSDs need to:

- Exchange information with issuers or issuer agents about new or existing issues – ranging from the creation of an issue on the CSD system (including ISIN creation) to activation of a new issue as part of a pre-arranged programme to specific corporate events affecting the issue.

- Exchange meeting information and results, and forward voting instructions.

- Receive corporate actions information or price information from external data vendors for non-domestic instruments CSDs can conduct all of this communication with issuers and information providers over SWIFT.

Transaction Reporting: Regulators

Under MiFID in the EU, all market activity needs to be reported to the regulator. CSDs can carry out reporting of transactions on behalf of their community to the relevant regulator over SWIFT.

World at your Finger Tips

Customers trade whenever and wherever

200+ Global Markets

Realtime Market Data Feeds. Buy / Sell in multiple market

Single Integrated Interface

All Departments connected under ONE System

Calculate Fees & Charges

Real time lien and calculation of fees and charges with complete audit and reporting

Connect Core Banking System in Realtime

Real time synchronization and access to core banking system

Scalable & Cost Effective

Introduce New Products Generate New streams of Income.