ZagTrader Market Making Surveillance, Performance & Monitoring System

Globalization of markets, technological advancement and integrated trading activities along with increasing pace of market innovation have led to enhanced cross-border and inter-linkage of markets worldwide comes the increasing challenge of detecting possible market misconduct.

Automated –Realtime Surveillance, Monitoring & Reporting.

ZagTrader Market Making Surveillance, Performance & Monitoring system offers systematic controls and surveillance procedures via a combination of traditional alerts-based monitoring and risk-based discovery as well as a multifaced approach to surveillance like risk exposure and violations, allowing exchanges to monitor, detect and alert the market watch of certain scenarios and threats that are happening in the market. Whether it was manipulation, failing to comply with the regulator’s requirements.

Real-time, cross-asset solution that enables the front office at firms to monitor for trading activities such as real-time position monitoring during execution and controls.

A combination of traditional alerts-based monitoring and risk-based discovery, we help compliance teams take a multifaceted approach to surveillance. The internal risk & rules engine that supports market or regulator rules, including pre-trade risk, such as price control, must be natively supported to avoid a high reject rate including Web Encryption using https protocol, FIX Encryption and Permissions matrix for accessibility.

The system supports All Asset Classes in multiple currencies with real-time rules application as per the risk controls to ensure compliance. All of this is transparently capturing audit real-time reports, alerts and notification via the dashboard as well as email and SMS.

ZagTrader Market Surveillance System will help you provide and maintain a safe and fair environment for your participants.

DETECT > Review & Investigate > Manage

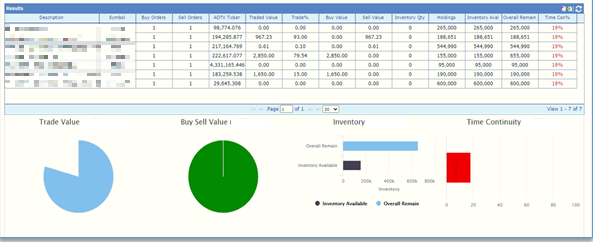

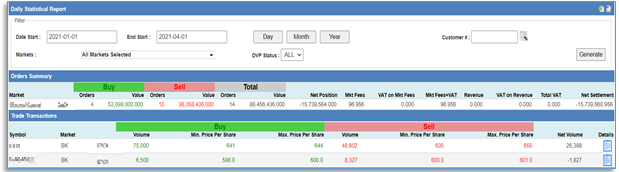

- Monitor Trading activities & violations via effective, targeted and transparent logic-based alerts and reports.

- Dynamic reporting tools, conditions and tools to leverage performance monitoring and reporting based on trading scenarios with timely access to relevant trading data.

- Efficient and real-time handling and processing of system alerts and outputs in order to further explore and flag risk.

On top of that you get regulatory reporting, real time dashboards and capabilities to extend the platform to do a lot more than what comes out of the box. ZagTrader’ plugins feature allows you to add and inject your own pre-trade and post trade rules that provide extensive and customized rules that would further fit your business requirements.

Our Market Making Surveillance, Performance & Monitoring system offers coverage for multiple asset classes such as equities, FX, Futures & Options, Commodities, Precious Metals & Fixed Income, the system also supports multiple currencies and languages.

Gain Transparency & Comply with Market Regulations

Scalable and Quick to Market

The platform from a technological perspective is web-based and has advanced trading screens that can be installed and is capable of sending orders via market specific APIs or as standard FIX, using mass quote messages to be able to deliver the quotes directly to the exchanges. The implementation will depend mostly on the documentation of the workflow expected so that they are properly implemented as per the parameterisation of the platform which is very straight forward and has been replicated by us in many projects in the past and present. In addition, the project timeline can be crashed in availing parallelism of deployed on exchange in terms of market data and connectivity rather than proceeding in a sequential manner.

List of Trading system / FIX version we have connected to:

- Nasdaq OMX

- Nasdaq X Stream

- NYSE Euronext

- GL (FIS)

- Fidessa

- Thompson Reuter (now known as Refinitiv)

- Bloomberg (EMSX, EMSX NET, TSOX)

- NYFIX (In/ Out)

- Horizon

- Millennium Datafeed FIX

- ZagTrader DMA

- 3rd party brokerage such as Interactive Brokers, Clearstream, Euroclear, etc.

- And many other custom and propriety development adaptors

The risk and market exposure that Market Making / Liquidity Provision entails absolutely requires an automated, risk controlled and high-speed system. With dedicated algorithms for each type of activity our solution allows firms to comply with regulatory, business and risk requirements while working to maximize profitability.

Features

- Reference instrument-based pricing with support for baskets, multiple listings and derivatives

- Theoretical price calculation including depth for the reference instrument

- Strategy (fully hedged, % hedged, open or any variance / event-based treatment)

- Min/Max Spread, Volume, Exposure, Gain/Loss and over a hundred other event-based variables

- Price and Volume references for Delta-1 Market Making

- Automated, Semi-Automated or Manual activity workflows

- Dedicated Market Making dashboard with all functionality on one screen

- Automate workflow and risk management and hedging activity

- Market condition-based triggers to allow for various algorithms/strategies depending on actual realized volatility and volume

- Market condition-based triggers to allow for various algorithms/strategies depending on actual realized volatility and volume

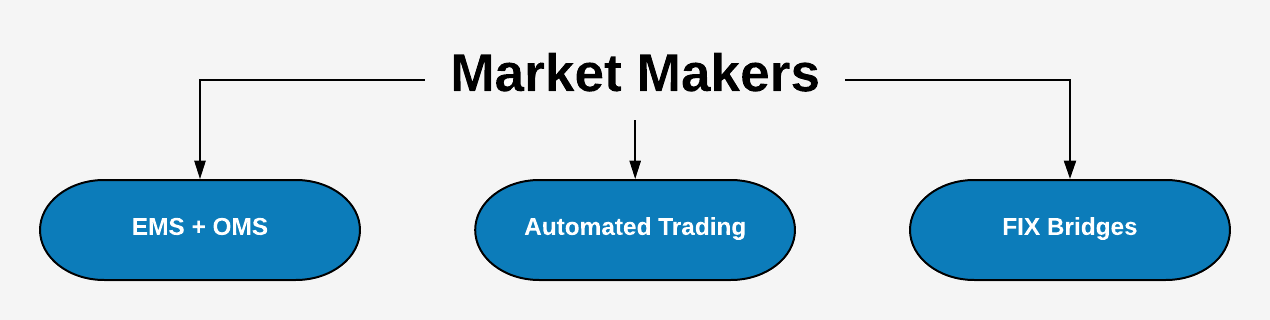

- Integrated with ZagTrader EMS, OMS, Clearing & Settlement system or a stand-alone solution that can be integrated with existing systems

Please feel free to give it a try and contact us for more information.

Key Benefits

- Order Book Supervision.

- Trade Monitoring and Alert System.

- Detect abuse / Risk Management.

- Maximum Spread Check.

- Order/Quote Depth.

- Order/Quote Price Validation.

- Rebate and Commission Calculations.

- Supervision Schedule.

- Alarms / Alerts / Conditions / Extensive Rules Engine.

- Minimum and maximum Value Check.

- Time continuity parameter compliance, and alerts.

- Customize extra analysis reports for surveillance department to follow the market maker’s performance. (value traded, volume traded, Min/Max spread analysis, etc…)

- Automate securities screening for liquidity buckets.

Flexibility and Scalability

- Open architecture: allows the traders to implement their own unique strategies.

- Create your own algorithms and rules or connect to any 3rd party algorithmic solution desired.

- Seamless integration with any 3rd party solutions if needed.

- The ability to run more than 100,000 symbols simultaneously.

- Extensive user privilege capabilities.

Supported Instruments

- Equities

- Futures Contracts

- Forex

- Derivatives

- ETFs

- Bonds and Sukuks

Improve Workflow

- Automated, Semi-Automated or Manual activity workflows

- Dedicated Market Making dashboard with all functionality on one screen

- Automate workflow and risk management and hedging activity

- Market condition based triggers to allow for various algorithms/strategies depending on actual realized volatility and volume

- Integrated with ZagTrader EMS, OMS, Clearing & Settlement system or a stand-alone solution that can be integrated with existing systems

Manage Risk & Compliance

- Real-time position, P&L, exposure, un-hedged exposure and VaR data

- Real-time alerts on thresholds, limits and activity

- Audit trail and regulatory reporting of presence, max-spread, bid/ask size

- AI analytical tools for back testing and forward testing

Connectivity

- Connectivity to hundreds of exchanges worldwide

- Connectivity to global routing networks (Bloomberg, Reuters, NYSE)

- Solution requires in-bound Data Feed connection (available from ZagTrader); and out-bound FIX connection for order routing to the Exchange/Clearing Member

For a complete list of ZagTrader's Global Features

Please Click Here