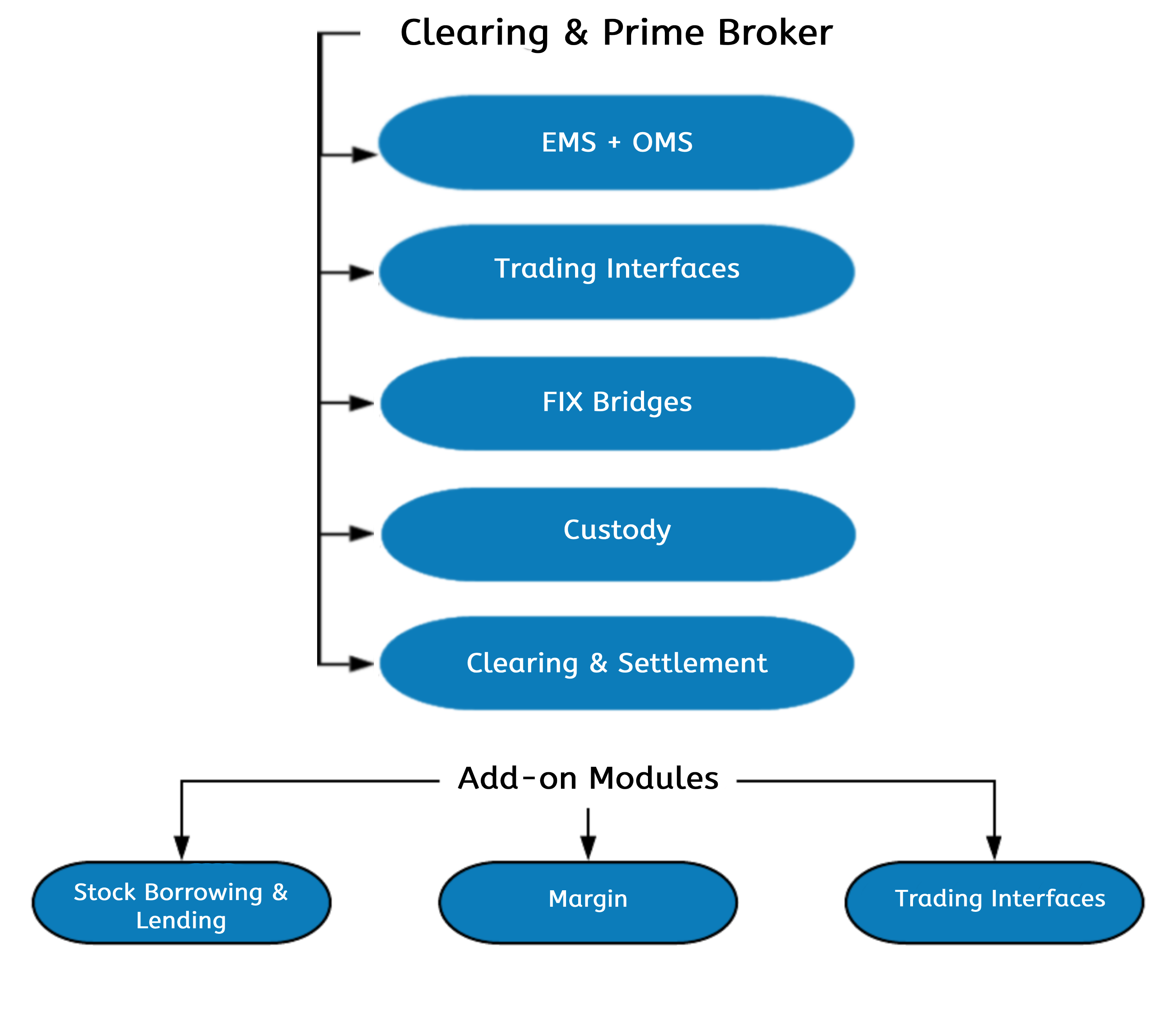

Clearing Members & Prime Brokers

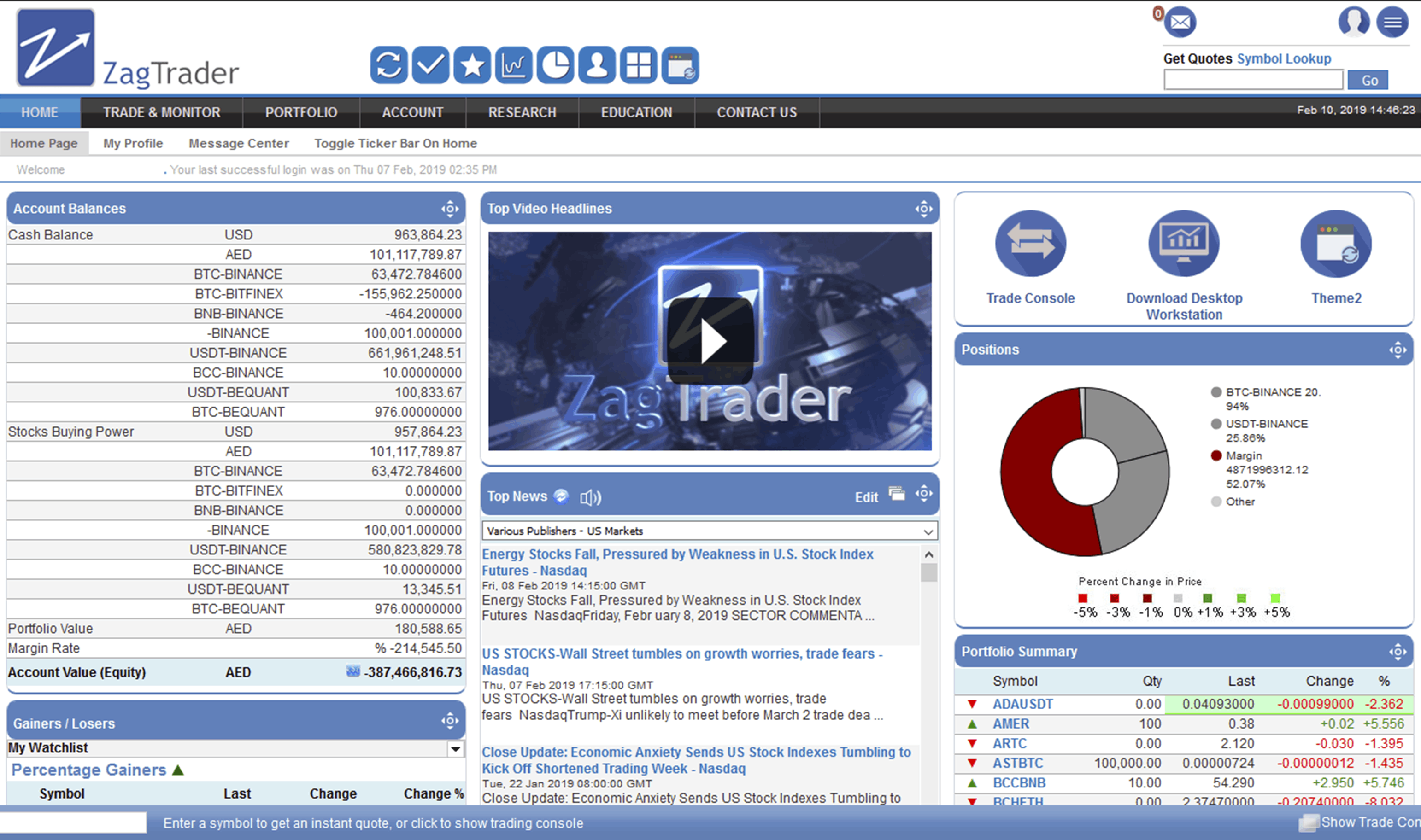

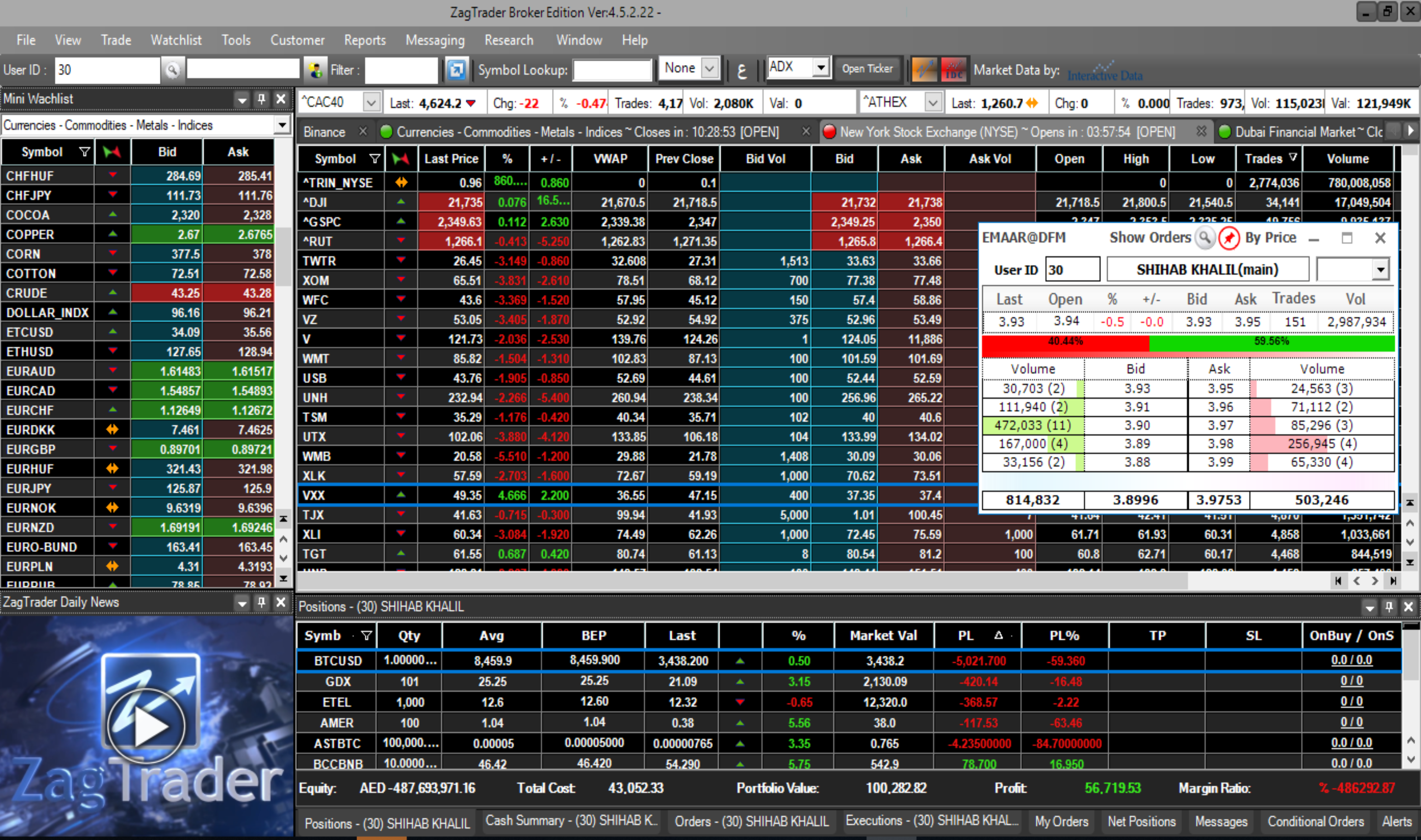

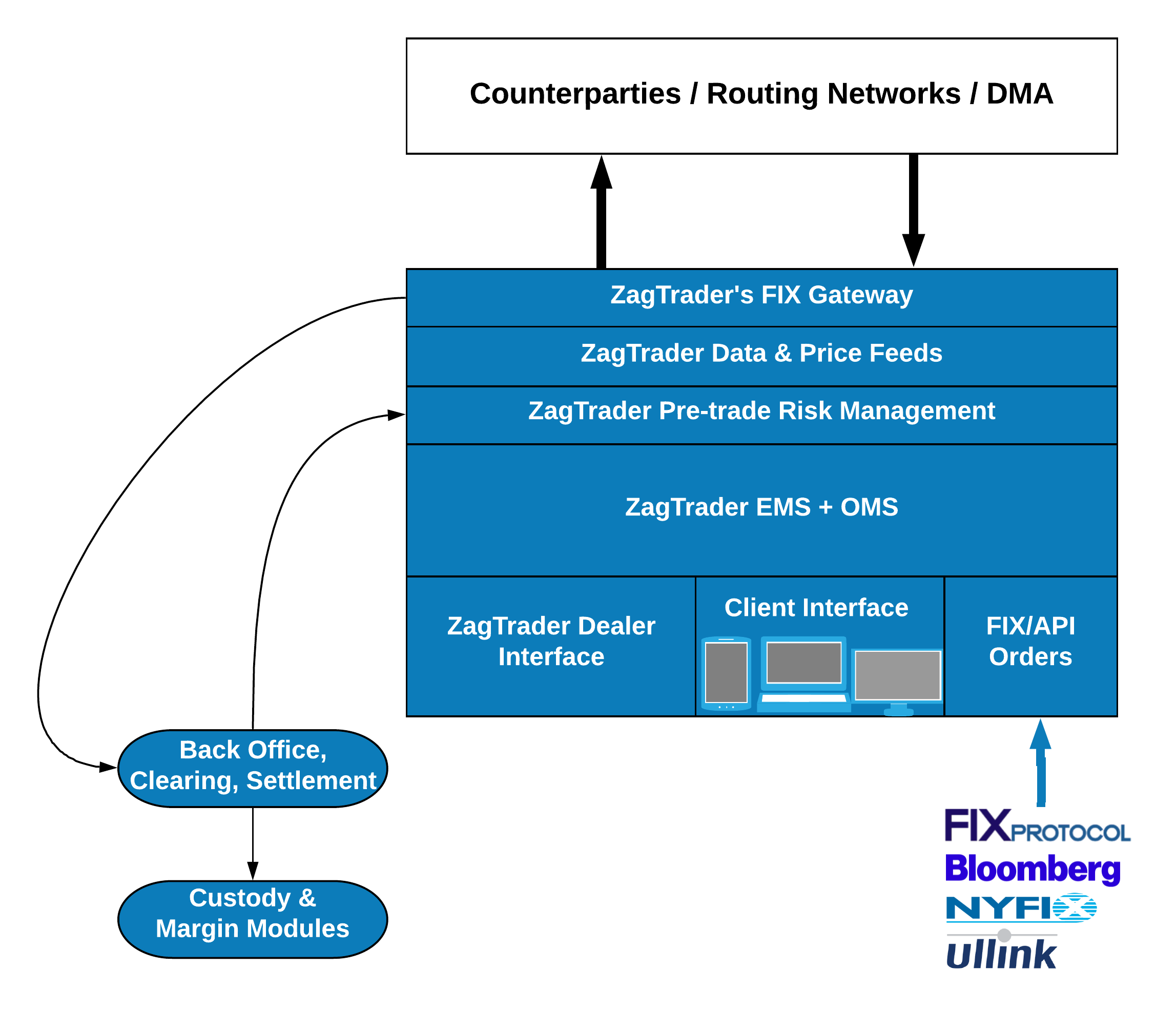

An integrated solution with modules covering the key functional, business and regulatory requirements of establishing and managing a brokerage firm as a Clearing Member on an exchange; or alternately as a Prime Broker. Complete EMS, OMS, Middle Office, Trading Interfaces, Client On-boarding and KYC, Clearing & Settlement and Custody management with a certified FIX bridge to the Exchange and available to external clients for DMA/FIX connectivity.

The ZagTrader Clearing Member solution captures the entire workflow, delivering functionality and connectivity designed to increase revenue, optimize efficiency, improve the Client experience and manage risk.

Supported Instruments

- Equities Long / Short

- Futures Contracts Long / Short

- Leveraged Forex Long / Short

- CFDs Long / Short

- Derivatives Long / Short

- ETFs Long / Short

- Bonds and Sukuks

- Options (Calls, Puts, Naked Calls/Puts)

- Funds

Improve Workflow

- Order flow capture and execution management with trading and sales workflows

- Algorithmic trading, event or rules based trading conditions

- Multi-Custodian and Multi-Destination capabilities with Sub-Custody, Omnibus and other complex account structures supported

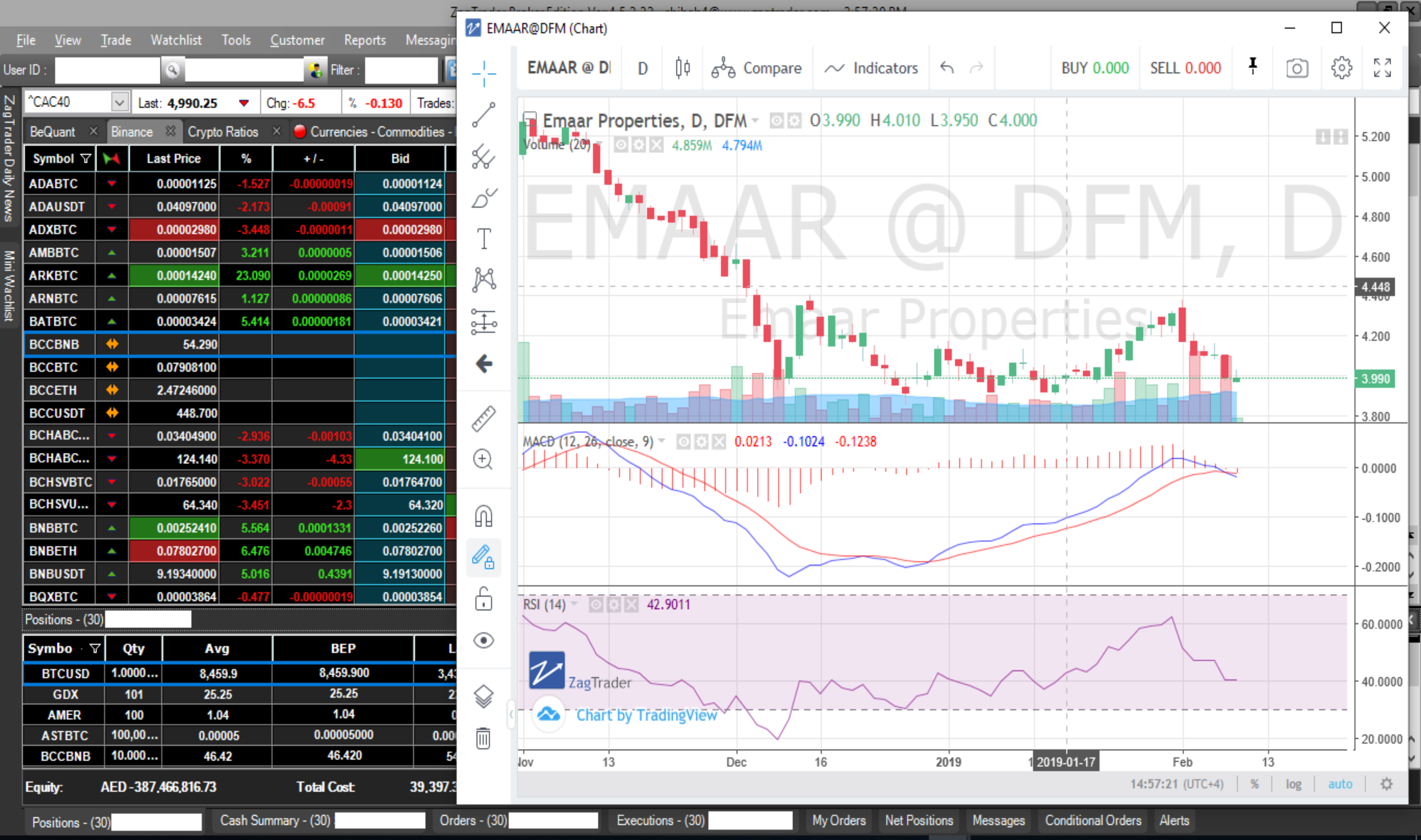

- Client and Trading interfaces that enable a completely digital experience from account opening to trading across Desktop, Web and native Tablet/Mobile applications

- Automated pre-trade Risk, reporting and liquidity alerts

Manage Risk & Compliance

- Real-time trade capture and reporting

- Real-time alerts on trade rejections, settlement limits, Client limits and thresholds

- Audit trail and regulatory compliant reporting at a User and Trade level

- Settlement & Clearing fails management, matching alerts and regulatory capital management

Direct & FIX Market Access

- Direct FIX connectivity to destinations and Clearing Members

- In and out-bound connectivity to global routing networks (Bloomberg, Reuters, NYFIX)

- Provide institutional DMA with high/low touch trading workflows and automated routing rules

- Provide Clients with a rich interface for trading with high throughput and low latency

Trading

- Pre-trade and Post-trade allocation capabilities, full support to manage a single order across multiple accounts in markets that force Pre-trade allocation

- Dealer interface developed to improve efficiency while providing capabilities for customizing all aspects of the layout, view, data and individual Dealer workflow

- Order authorization management for escalating order approvals internally across a Firm

- Internal ‘Chat’ tool allowing Dealers across multiple offices to remain in contact easily when managing order flow

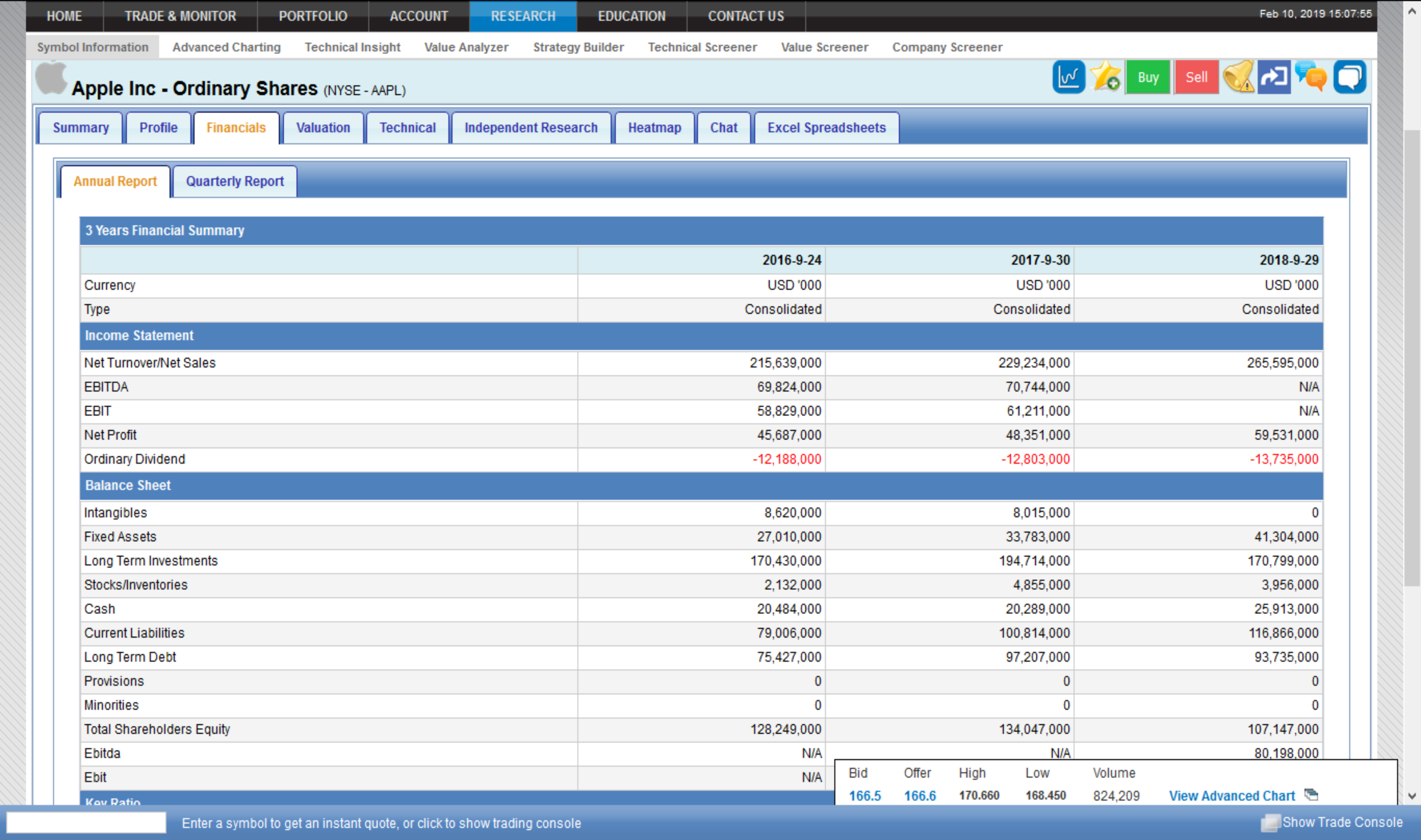

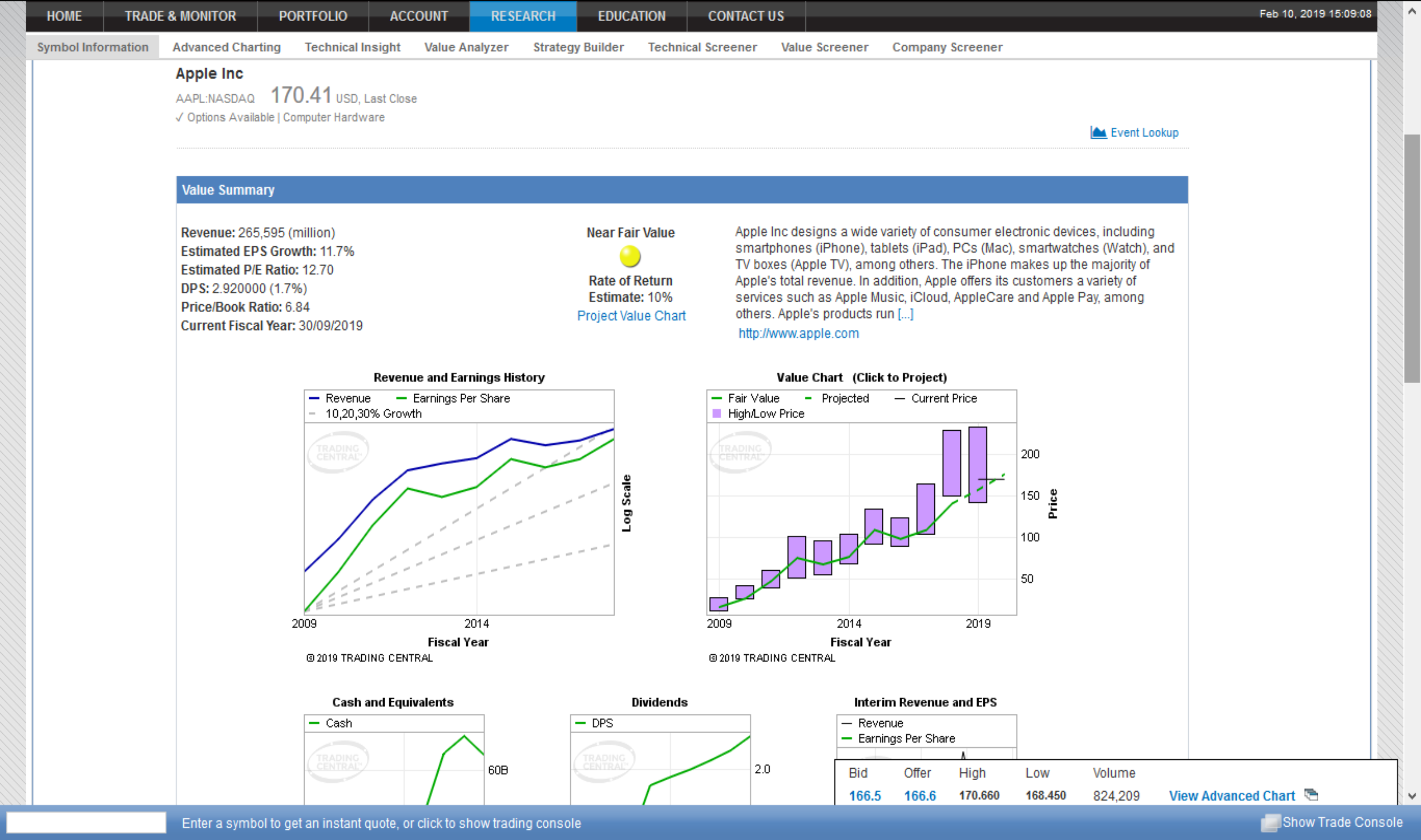

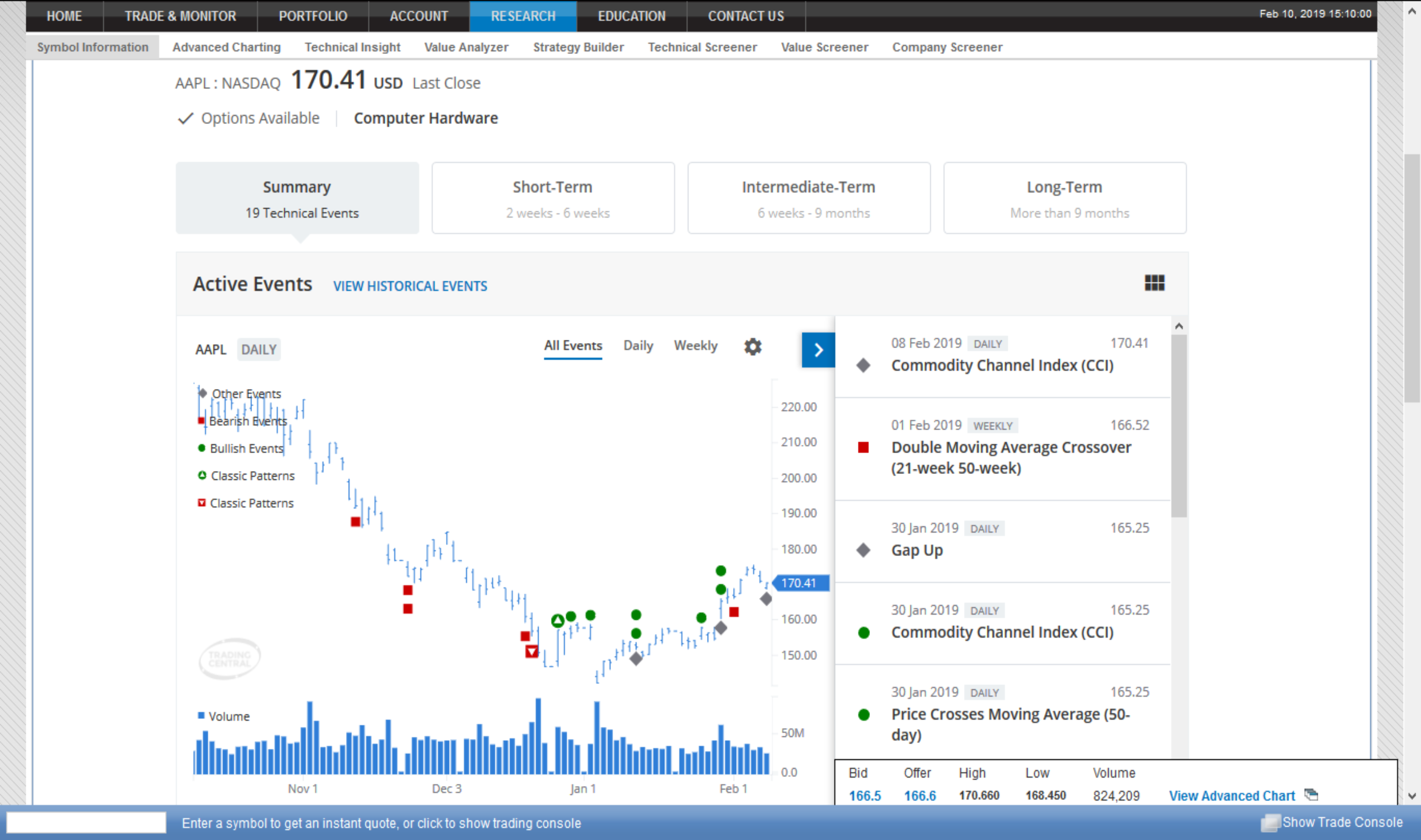

Research & Data

- News feed from external data vendors or ZT Data & Price Feeds

- Data Feed handler to process and distribute the feeds

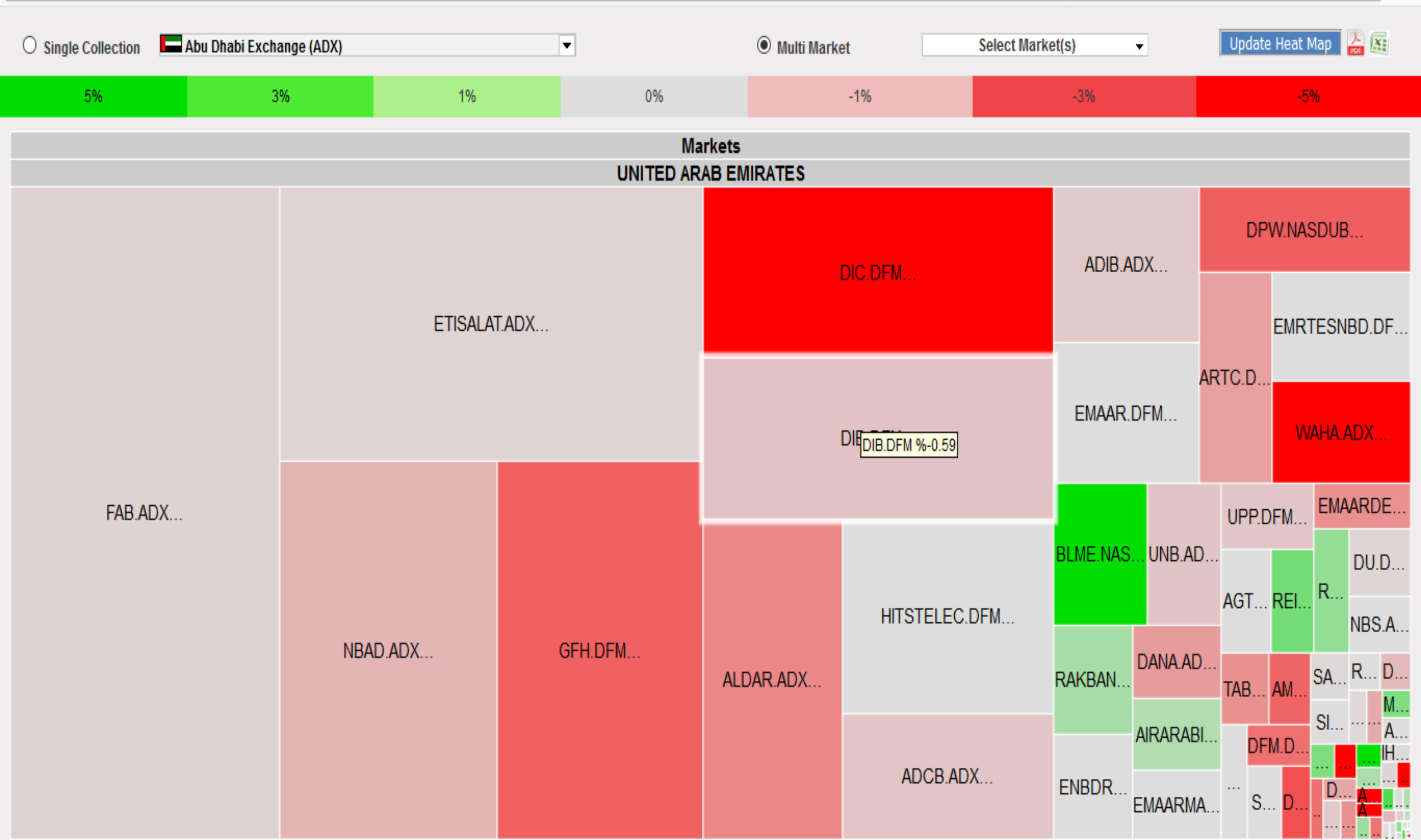

- Charting, Analytics and Back-testing built into the solution

- Ability to provide Fundamental and company data within the solution

Flexibility and Scalability

- Open architecture: allows the traders to implement their own unique strategies

- Providing white label solutions to other financial institutions

- Seamless integration with any external or legacy systems if needed

- The ability to run more than 100,000 symbols simultaneously

Backoffice

- Modules covering Clearing, Settlement and Custodian management

- Ability to handle trading Settlement on a DVP/RVP basis with multiple external Custodians and Sub-Custodians

- Automated workflow for preparing and processing Settlement instructions, transfers and confirmations

- Corporate Action management and reporting

- Client Reporting in customized CSV, Text, PDF reports or via direct Client Access updated in real-time

- Distributed Backoffice support with defined User rights and ability to manage workflow across multiple physical locations in real-time

For a complete list of ZagTrader's Global Features

Please Click Here