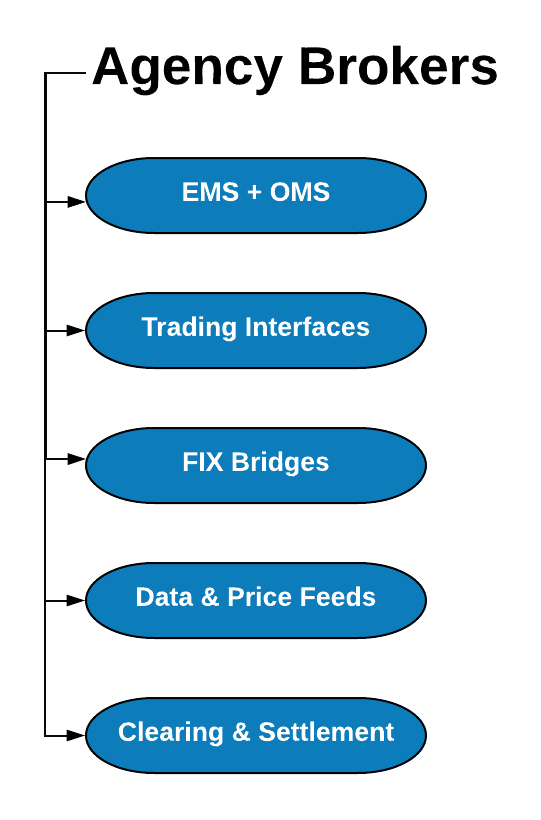

Agency Brokers

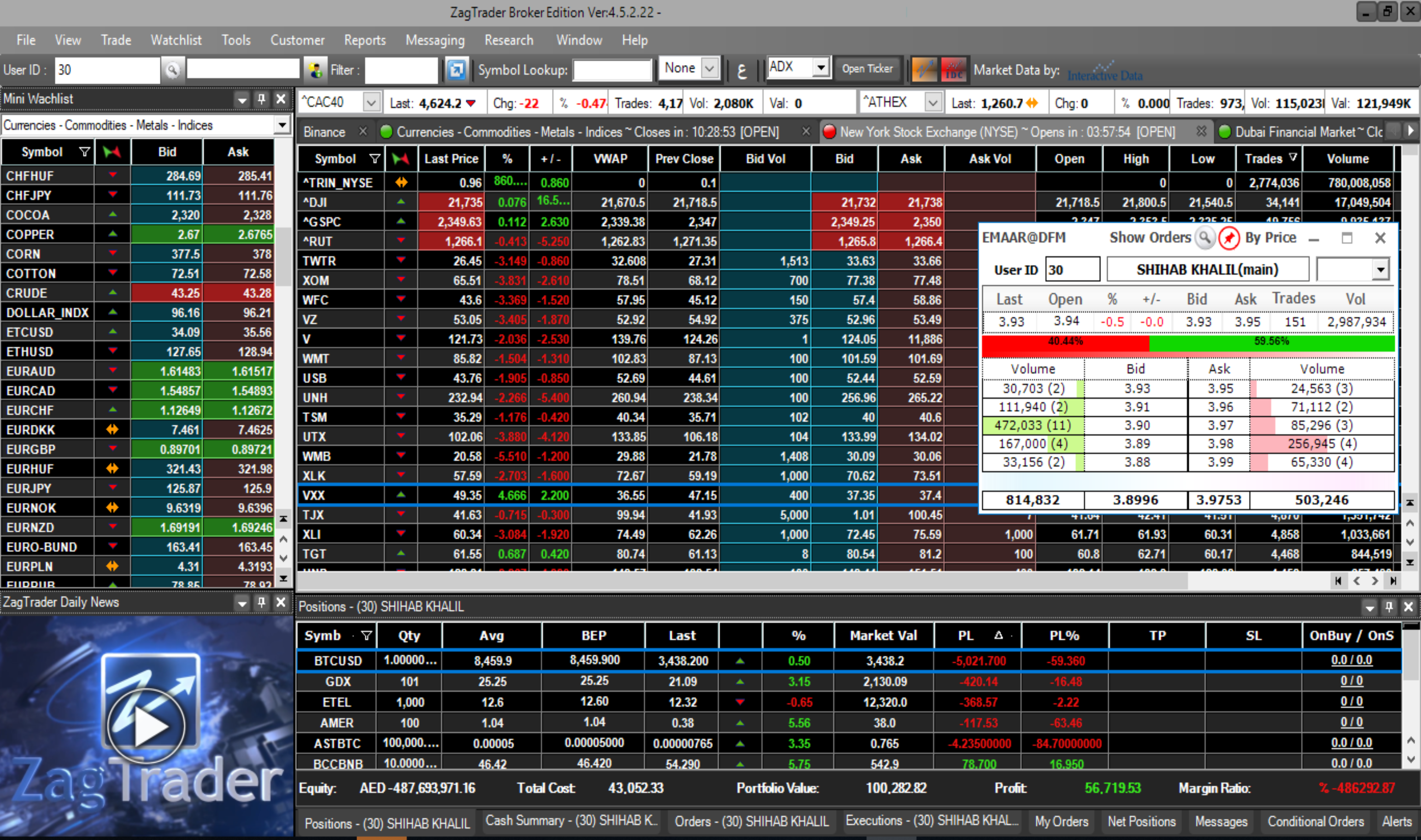

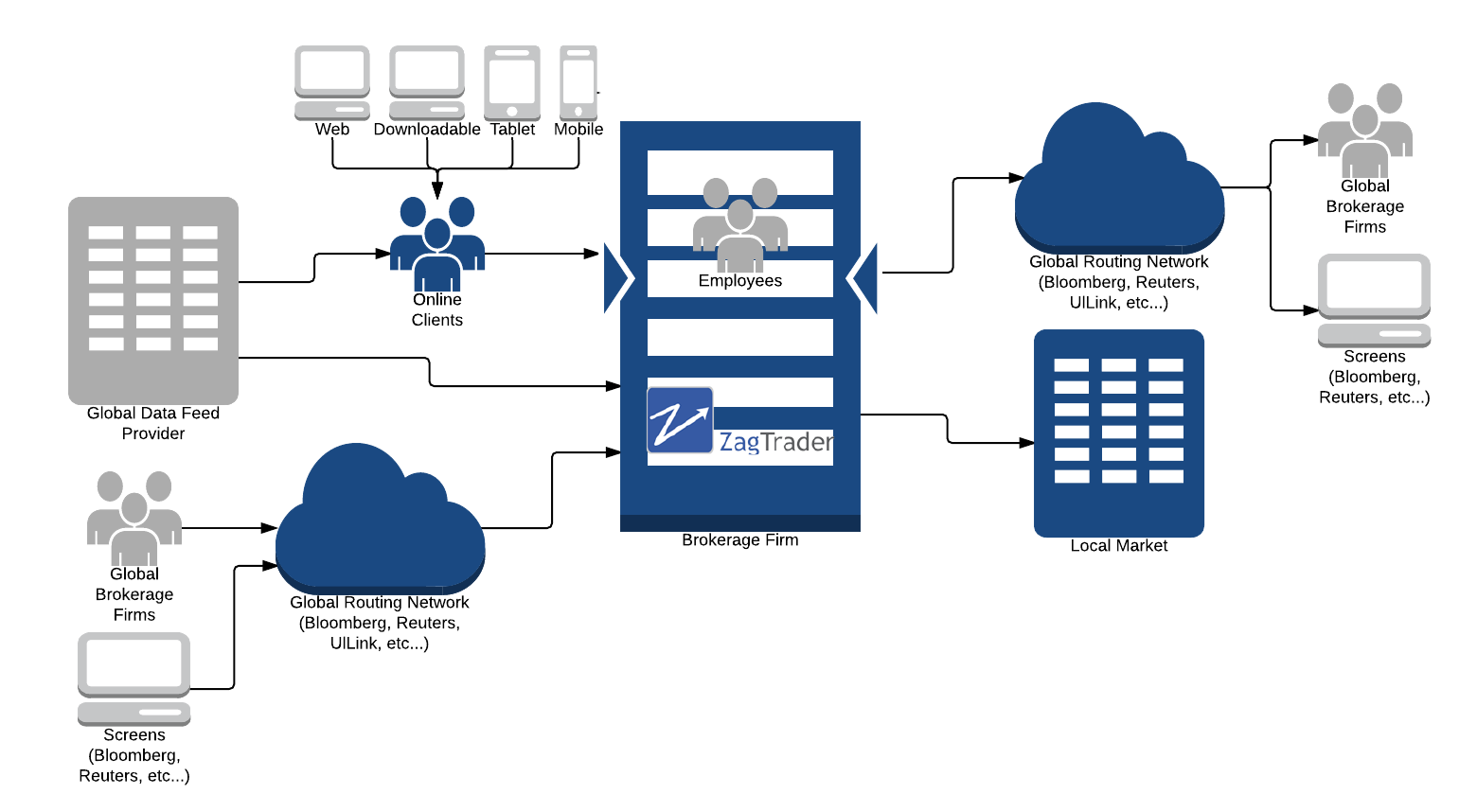

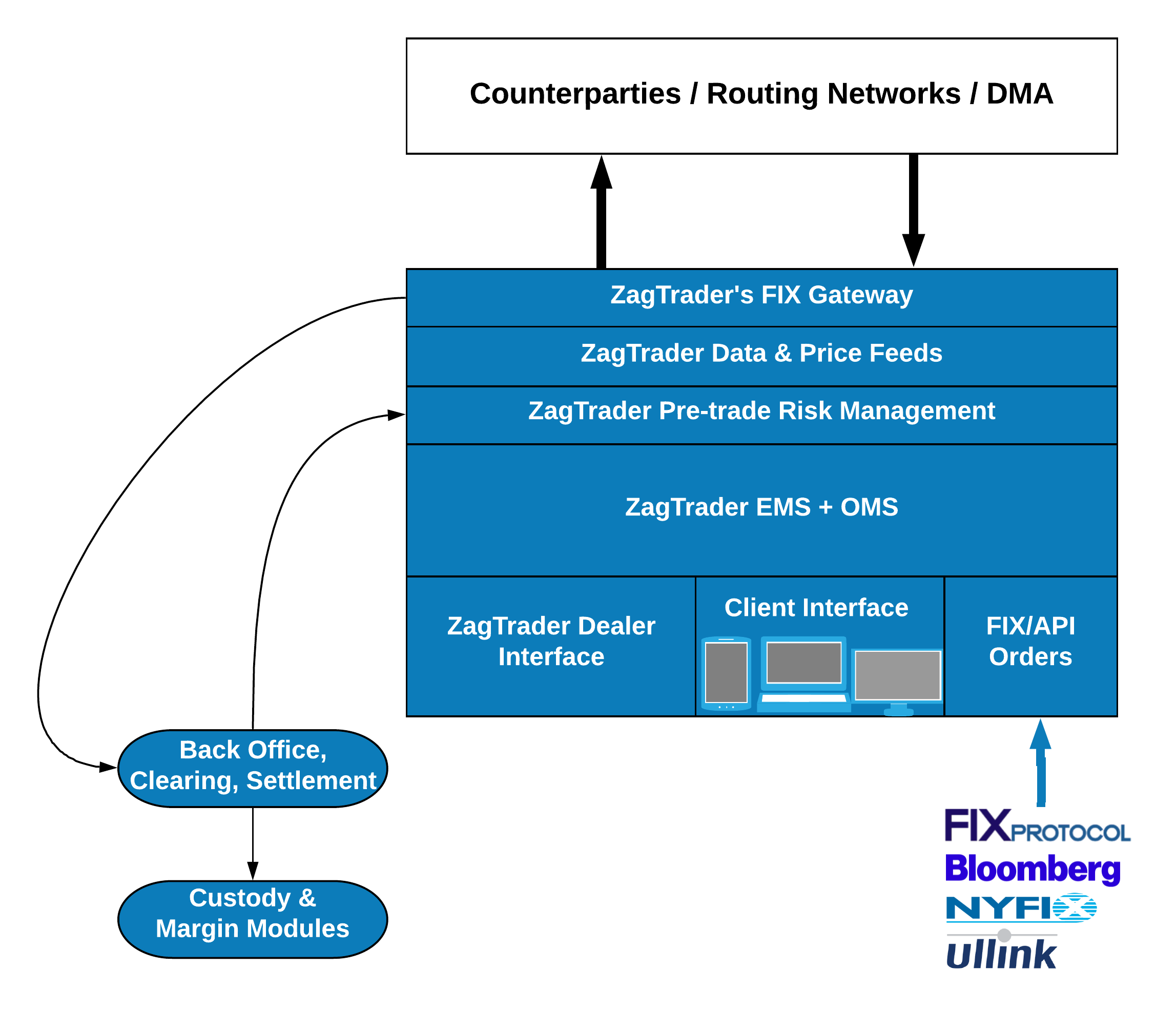

An integrated solution with modules covering the key functional, business and regulatory requirements of establishing and managing an Agency Brokerage firm. Complete EMS, OMS, Middle Office, Data & Price Feeds, Trading Interfaces, Client On-boarding and KYC, integration with external Custody relationship, and Clearing & Settlement management with a FIX bridge to destinations and available to external clients for in-bound order routing.

The ZagTrader Agency Brokerage solution captures the entire workflow, delivering functionality and connectivity designed to increase revenue, optimize efficiency, improve the Client experience and manage risk.

Supported Instruments

- Equities Long / Short

- Futures Contracts Long / Short

- Leveraged Forex Long / Short

- CFDs Long / Short

- Derivatives Long / Short

- ETFs Long / Short

- Bonds and Sukuks

- Options (Calls, Puts, Naked Calls/Puts)

- Funds

Improve Workflow

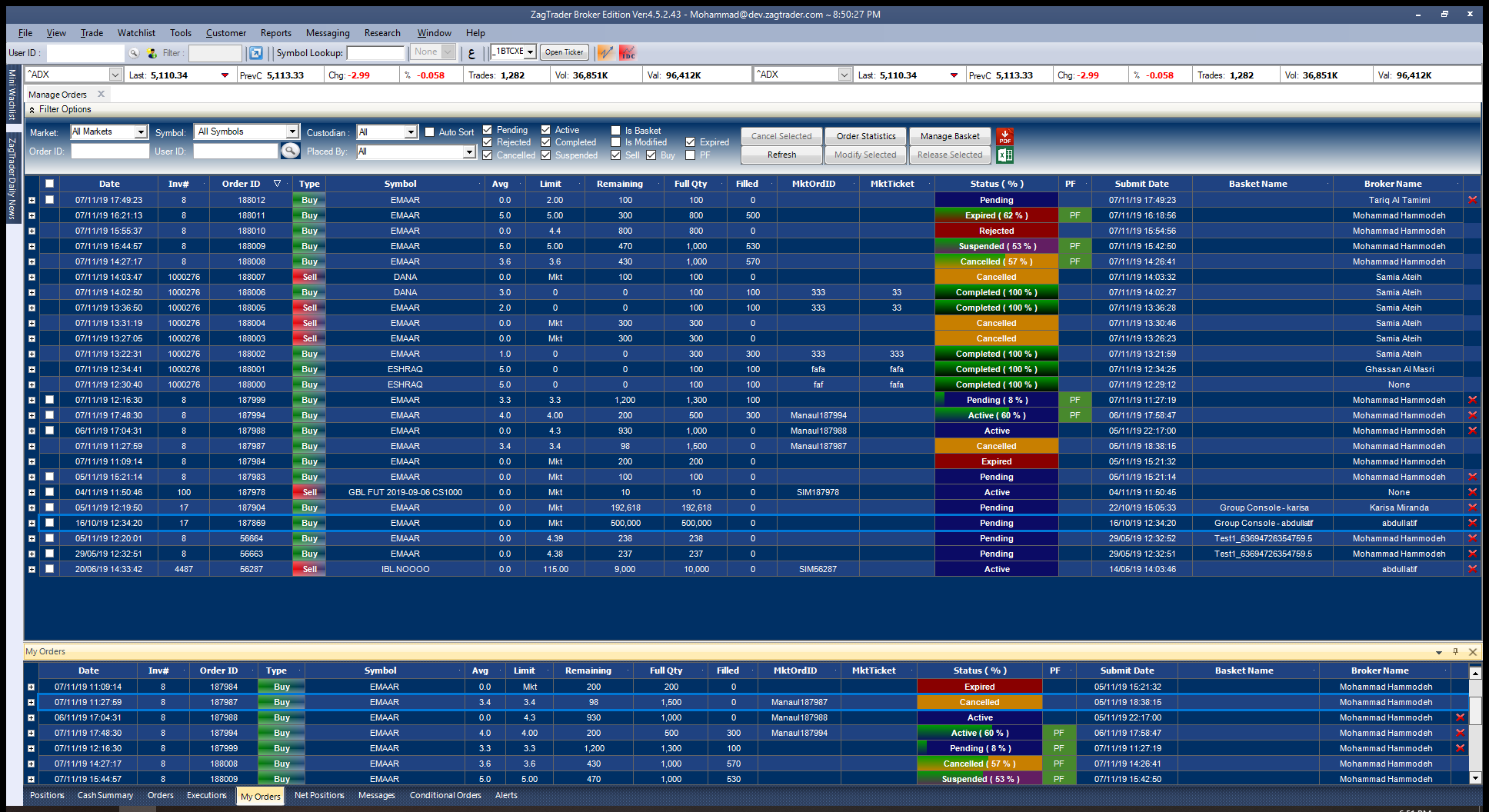

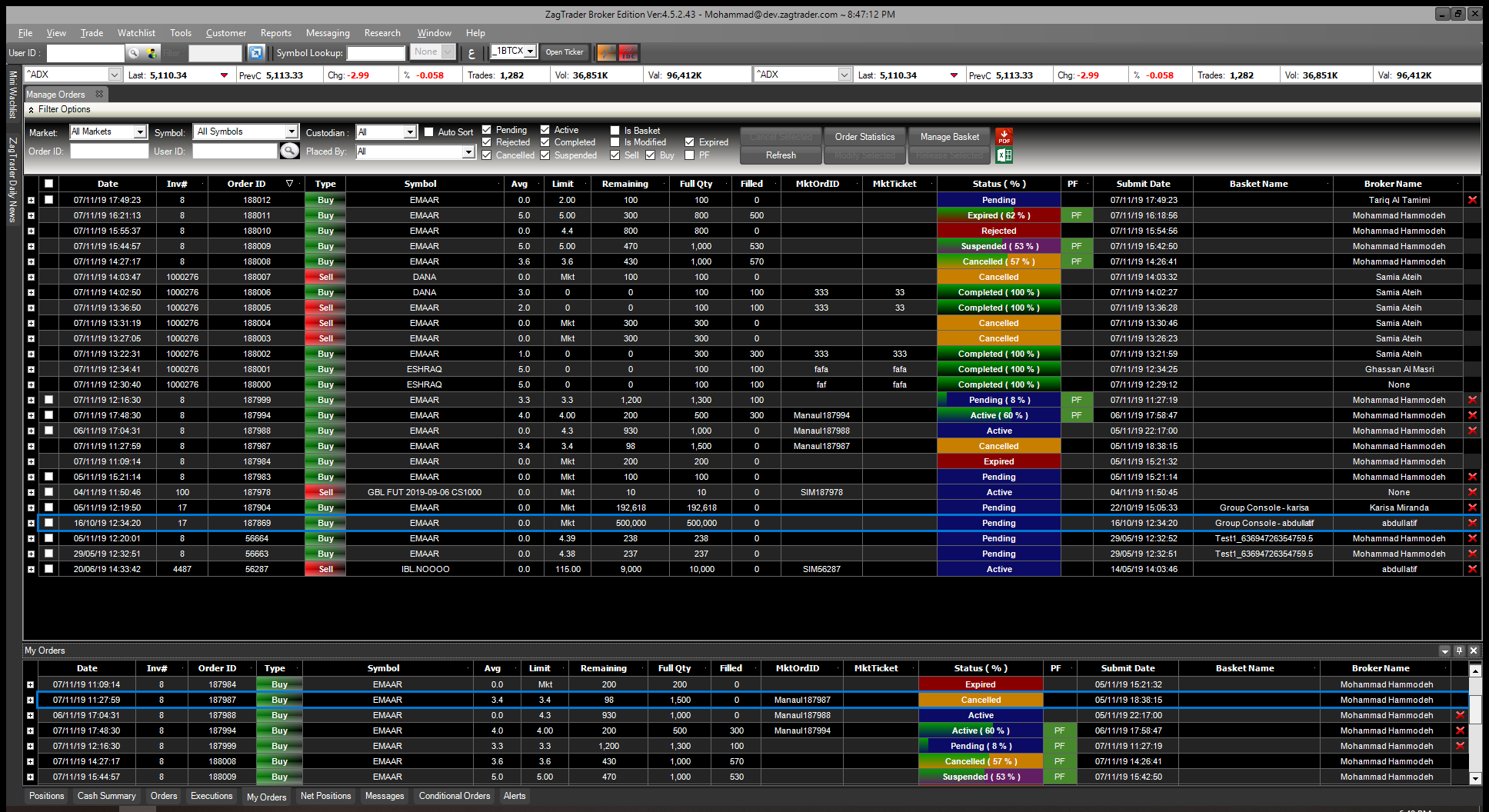

- Order flow capture and execution management with trading and sales workflows

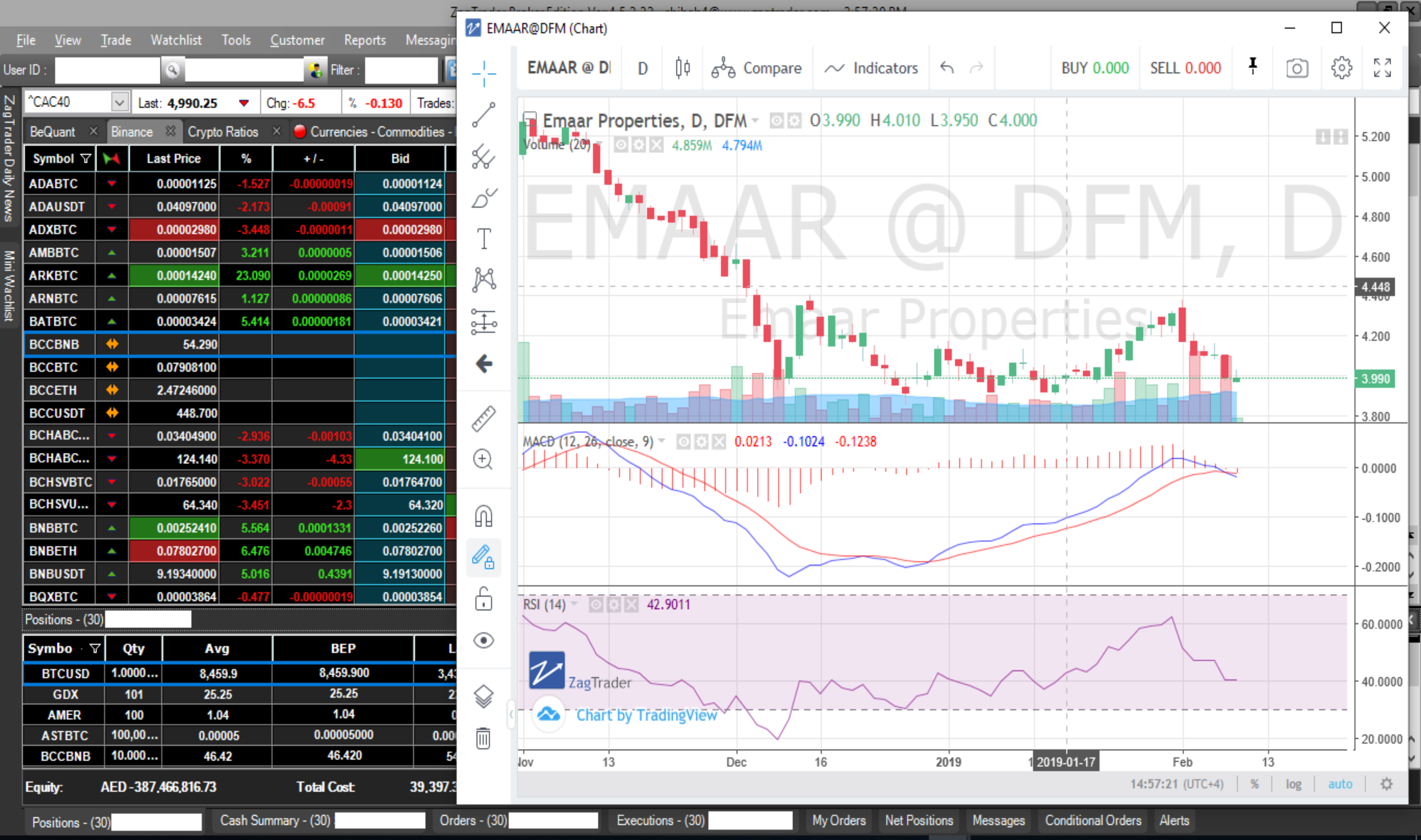

- Algorithmic trading, event or rules based trading conditions

- Multi-Custodian and Multi-Destination capabilities with Sub-Custody, Omnibus and other complex account structures supported

- Client and Trading interfaces that enable a completely digital experience from account opening to trading across Desktop, Web and native Tablet/Mobile applications

- Automated pre-trade Risk, reporting and liquidity alerts

Manage Risk & Compliance

- Real-time trade capture and reporting

- Real-time alerts on trade rejections, settlement limits, Client limits and thresholds

- Audit trail and regulatory compliant reporting at a User and Trade level

- Settlement & Clearing fails management, matching alerts and regulatory capital management

Direct & FIX Market Access

- Direct FIX connectivity to destinations and Clearing Members

- In and out-bound connectivity to global routing networks (Bloomberg, Reuters, NYFIX)

- Provide institutional DMA with high/low touch trading workflows and automated routing rules

- Provide Clients with a rich interface for trading with high throughput and low latency

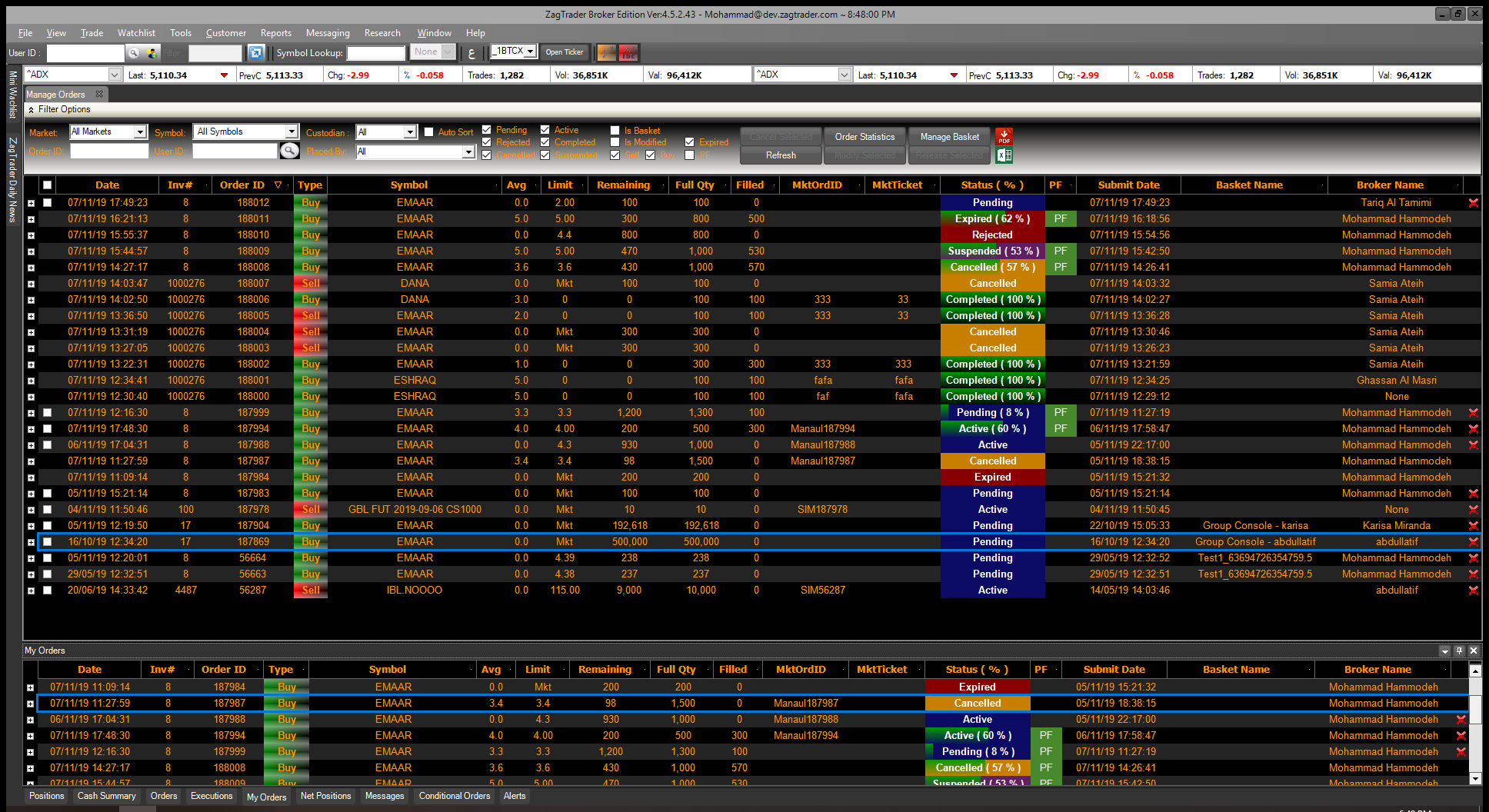

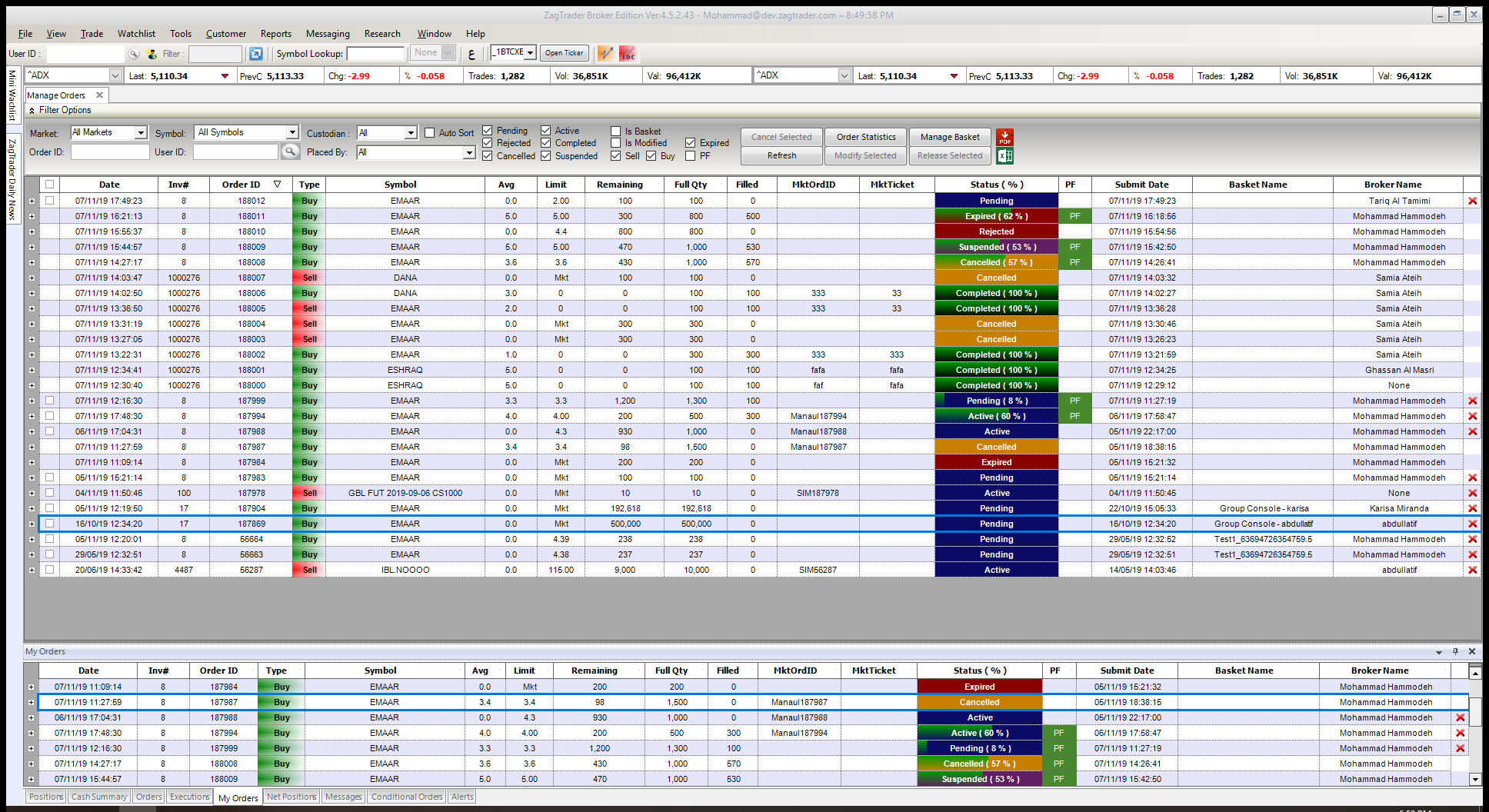

Trading

- Pre-trade and Post-trade allocation capabilities, full support to manage a single order across multiple accounts in markets that force Pre-trade allocation

- Dealer interface developed to improve efficiency while providing capabilities for customizing all aspects of the layout, view, data and individual Dealer workflow

- Order authorization management for escalating order approvals internally across a Firm

- Internal ‘Chat’ tool allowing Dealers across multiple offices to remain in contact easily when managing order flow

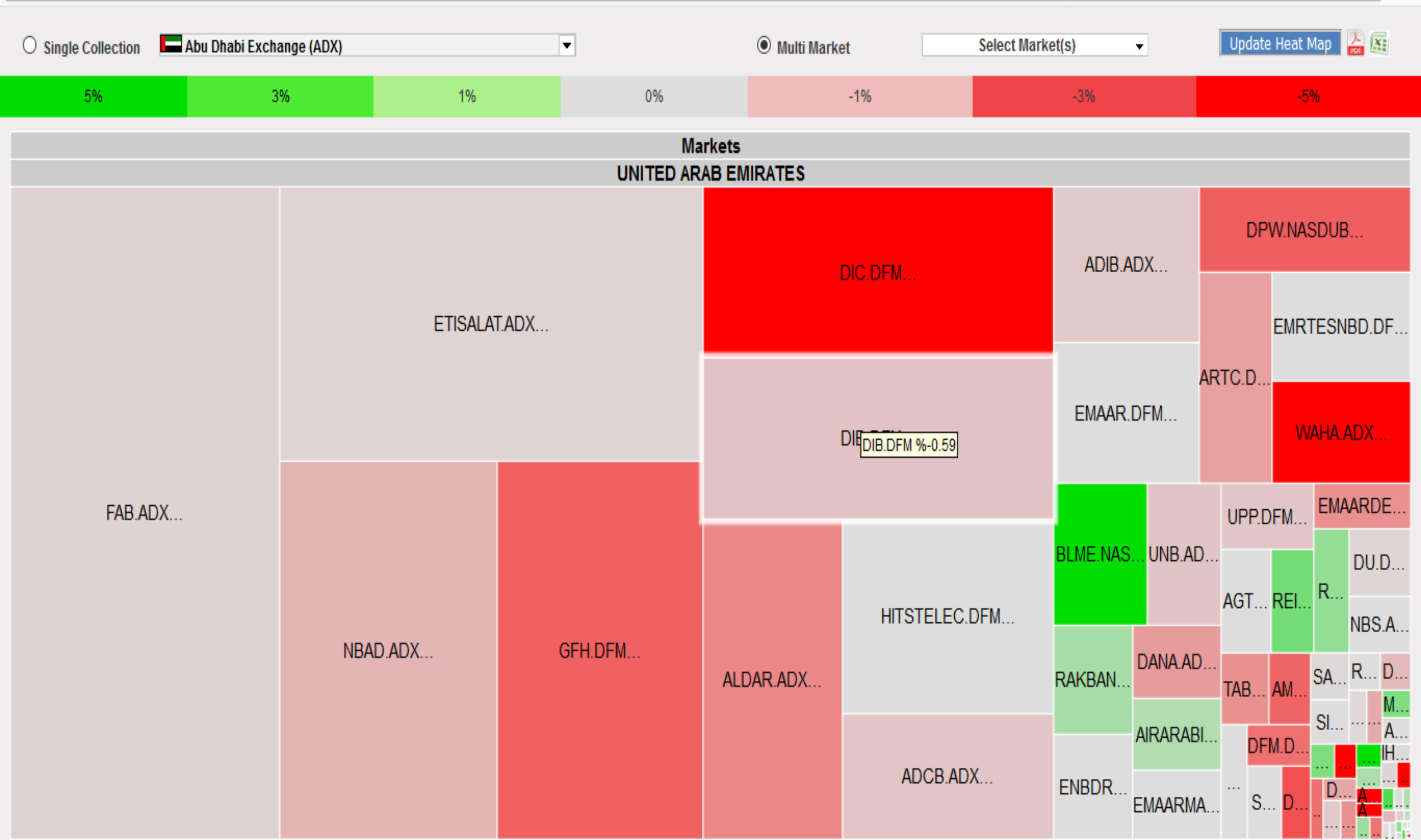

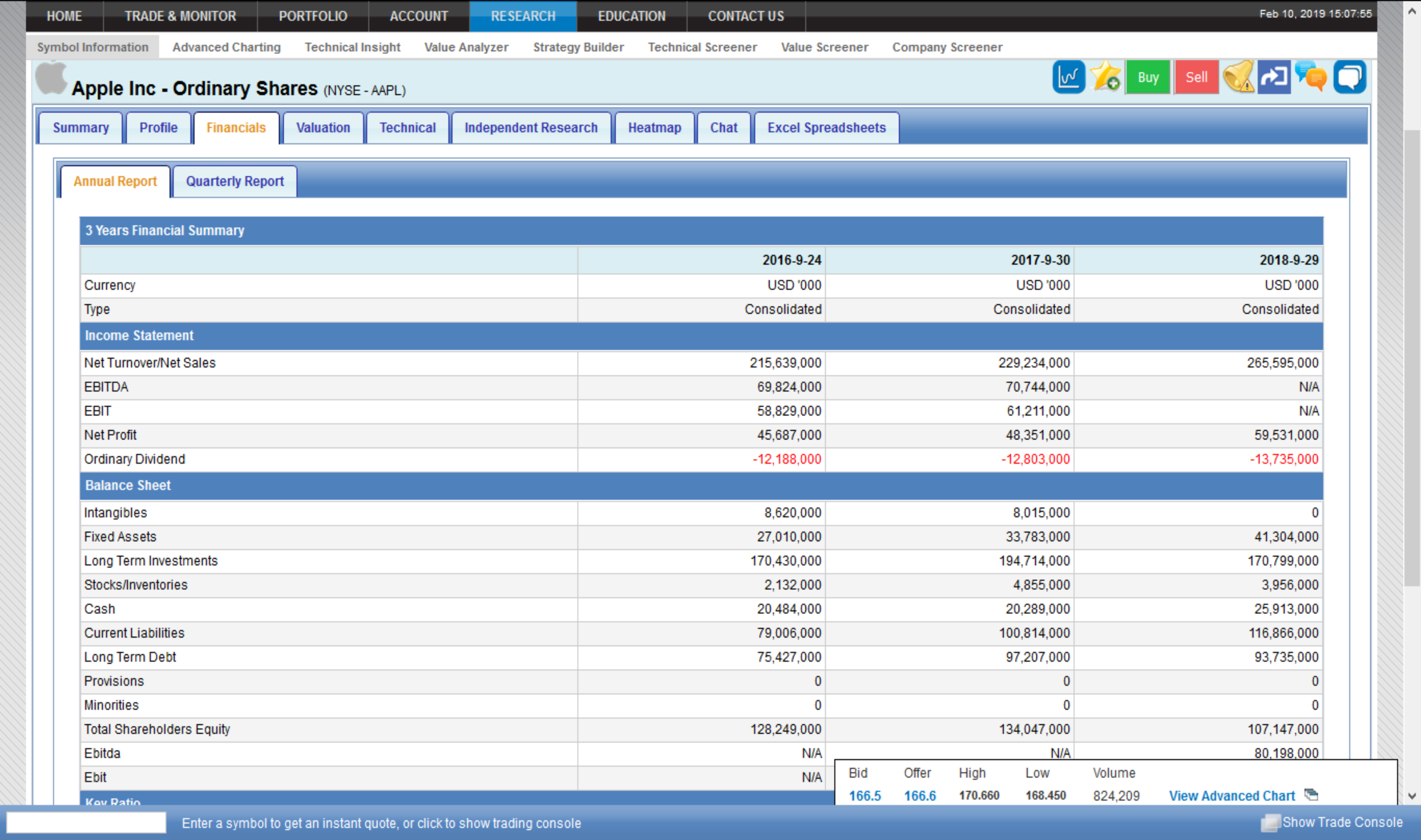

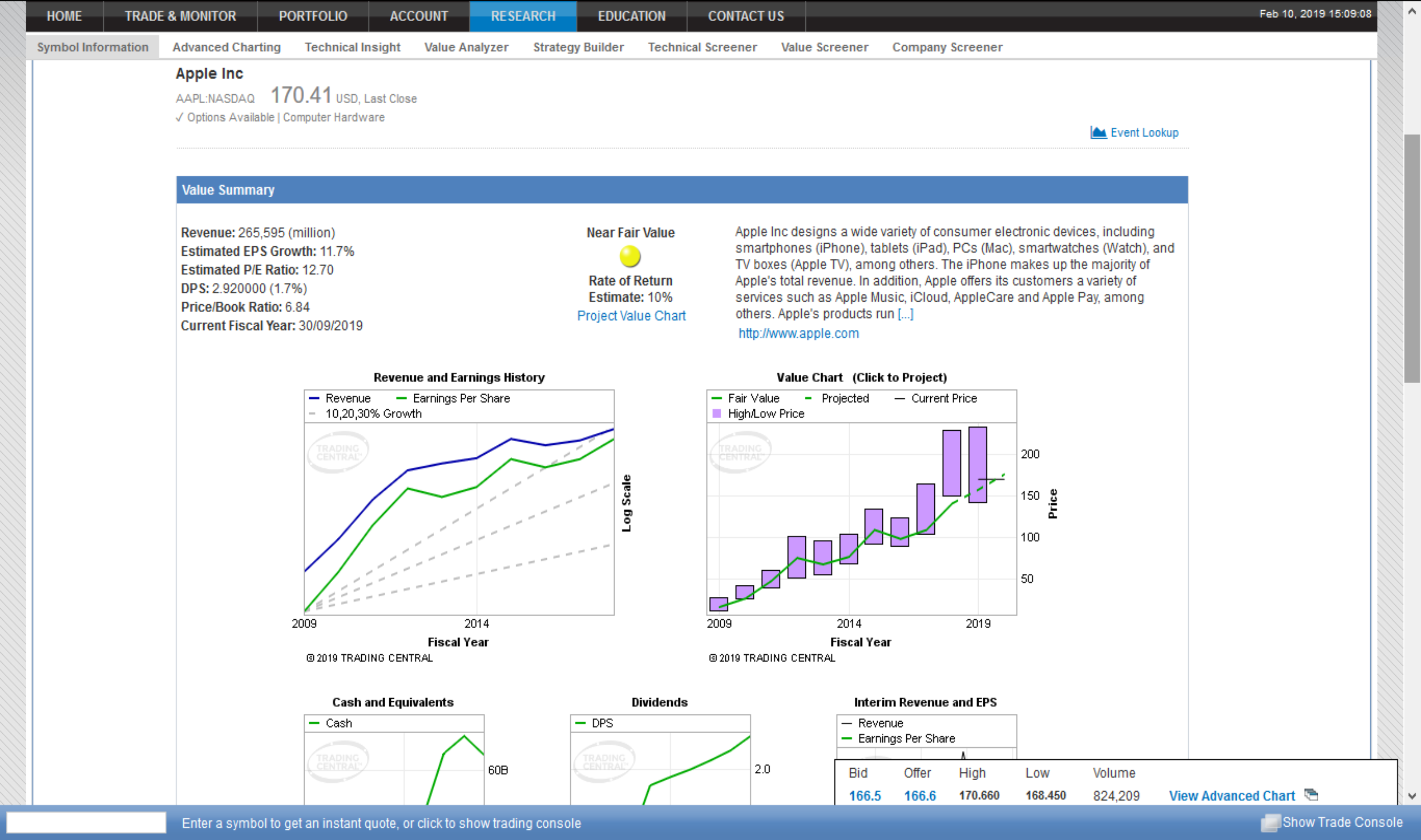

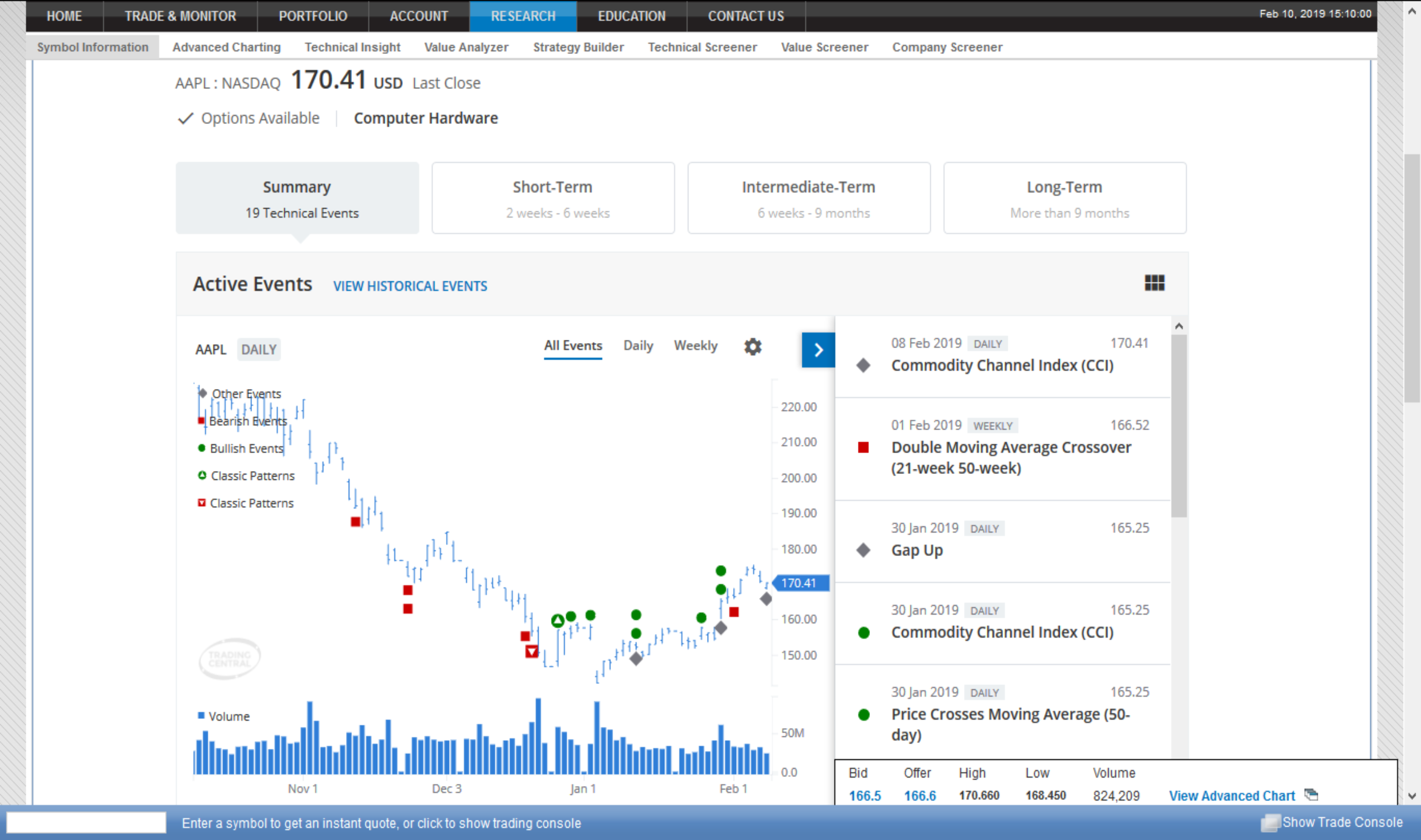

Research & Data

- News feed from external data vendors or ZT Data & Price Feeds

- Data Feed handler to process and distribute the feeds

- Charting, Analytics and Back-testing built into the solution

- Ability to provide Fundamental and company data within the solution

Flexibility & Scalability

- Open architecture: allows the traders to implement their own unique strategies

- Providing white label solutions to other financial institutions

- Seamless integration with any external or legacy systems if needed

- The ability to run more than 100,000 symbols simultaneously

Backoffice

- Modules covering Clearing, Settlement and Custodian management

- Ability to handle trading Settlement on a DVP/RVP basis with multiple external Custodians and Sub-Custodians

- Automated workflow for preparing and processing Settlement instructions, transfers and confirmations

- Corporate Action management and reporting

- Client Reporting in customized CSV, Text, PDF reports or via direct Client Access updated in real-time

- Distributed Backoffice support with defined User rights and ability to manage workflow across multiple physical locations in real-time

For a complete list of ZagTrader's Global Features

Please Click Here