Custody Management System

Custodians Worldwide

Custodians worldwide hold a range of assets Including Equities, Government Bonds, Corporate Bonds, Mutual Funds, Debt Instruments, Warrants and Derivatives on behalf of their customers. Institutions, money managers, brokers and dealers are amongst those that rely on a Custodian for efficient, secure and regulatory compliant handling of their assets.

The demand for custodial services has driven a need for sophisticated real-time technology solutions that capture the ownership transfer and reporting in the securities industry.

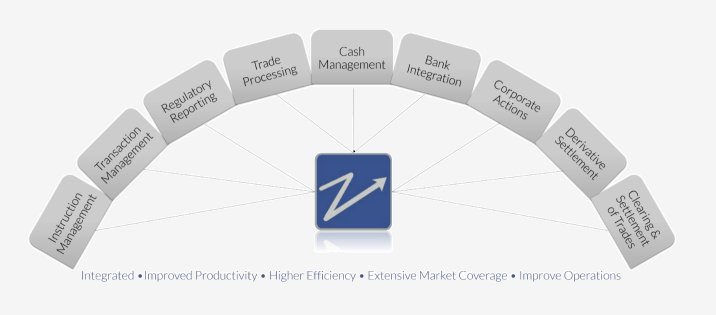

ZagTrader’s Custody Management System is an integrated Custody Management platform that can be fully integrated with our own EMS, OMS, Clearing & Settlement, Portfolio and Fund management products to provide regulated Custody services for Clearing Members, Funds, Segregated Accounts and Brokers to ensure proper reporting and safekeeping of their own or Client assets.

The Custody System supports global investment activities, Sub-Custodians, DVP, FOP and own custody processes. Integration with global Custodians and providers such as EuroClear, Clearstream and HSBC is enabled on a real-time, EoD and on-demand basis.

ZagTrader Custody Management provides a complete solution to manage a Custody business.

Key Functionalities

- Integration with Clearing & Settlement

- Corporate Actions data feeds, workflow automation and reporting

- Custody Management across global markets and time zones

- Regulatory reporting, segregation and compliance

- Custody Fee accruals, custom calculation logic and reporting

- Real Time custody management and synchronization

Advantages

- Real-time or periodic STP with complete audit trail.

- Intuitive Security Definition and specification interface

- High scalability and ability for Distributed users across global offices with real-time synchronization

- Easily integrated with ZagTrader or external Trading, Middle and Back office systems

Technical Features

- Built with extensive security features, tighter monitoring, and control.

- Open architecture allowing it to integrate with other systems.

- Multi-depositary, multi-instrument support.

- Parameterized audit trail.