Market Makers & Liquidity Providers

ZagTrader Market Making system is the next generation market making technology and is growing on a very fast paced rate compared to any other standalone market making systems out there.

Not all market making systems are created equally, the ZagTrader market making system is carefully balanced between multiple components which works in tandem to deliver a cutting-edge experience for the end user which includes data feed management along with institutional algorithmic trading for your front, middle and back office, all working together, delivering this unmatched experience.

On top of that you get regulatory reporting, real time dashboards and capabilities to extend the platform to do a lot more than what comes out of the box. ZagTrader’ plugins feature allows you to add and inject your own pre trade and post trade rules that provide extensive and customized rules that would further fit your business requirements.

The ZagTrader Market Making platform is so powerful that it does not only works on equity but also on ETFs and is able to create pricing theoretically based on underlying, it also includes digital assets.

It is multi-asset based; multi-user based and can also fit within a bigger scope of an asset management or can run independently on its own.

If it is working within an asset management space, the configurations can allow the market making administrator to be defined, with certain limits as a regular employee, who is already using the platform like anybody else.

What Sets Us Apart

ZagTrader Market Making system, is part of a much bigger scope and is an end-to-end single integrated platform that includes front - middle - back office and can provide a lot more than other standalone isolated platforms that need to integrate with other 3rd party systems and data feeds and unable to understand all of the local exchange specific requirements.

ZagTrader Market Making System uses the ZagTrader’ award-winning Execution Management and Order Management, which also understands, major and minor currencies, quotes, global data and others…, It is available for all the existing ZagTrader clients and any new client can have the ZagTrader Market Making system to be instantly deployed in a very short period of time and will be able to use it immediately out of the box.

Scalable and Quick to Market

The platform from a technological perspective is web-based and has advanced trading screens that can be installed and is capable of sending orders via market specific APIs or as standard FIX, using mass quote messages to be able to deliver the quotes directly to the exchanges.

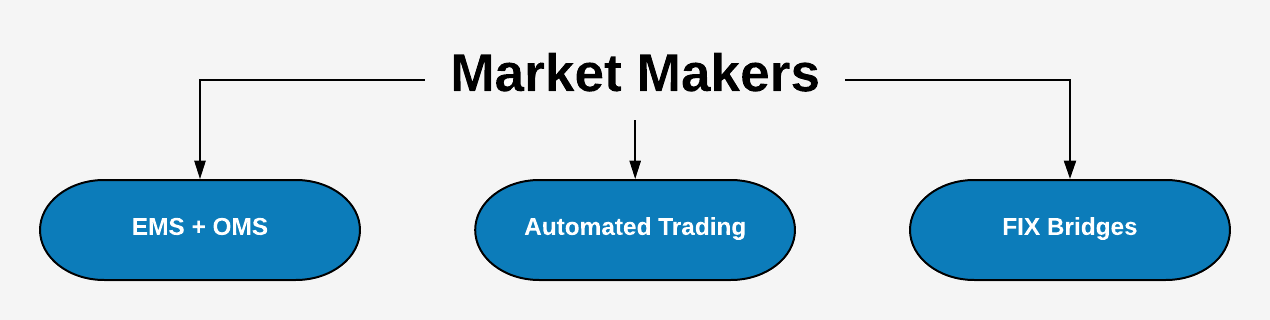

The Market Making and Liquidity Provision solution is a combination of more than one product that delivers an end-to-end solution for firms involved in this activity. The risk and market exposure that Market Making / Liquidity Provision entails absolutely requires an automated, risk controlled and high-speed system. With dedicated algorithms for each type of activity our solution allows firms to comply with regulatory, business and risk requirements while working to maximize profitability.

Features

- Reference instrument based pricing with support for baskets, multiple listings and derivatives

- Theoretical price calculation including depth for the reference instrument

- Strategy (fully hedged, % hedged, open or any variance / event-based treatment)

- Min/Max Spread, Volume, Exposure, Gain/Loss and over a hundred other event-based variables

- Price and Volume references for Delta-1 Market Making

Please feel free to give it a try and contact us for more information.

Key Benefits

- Managing your employees with Full privilege/permission system

- Automation of clients onboarding (KYC) with inbuild Document Management

- Capabilities to route your orders to multiple destinations

- Risk Management

- Algo Trading

- Mobilize your customers with white-labelled mobile and tablet apps to view and trade their portfolio in real time

- Fully white-labeled solution with fast deployment

Flexibility and Scalability

- Open architecture: allows the traders to implement their own unique strategies

- Create your own algorithms and rules or connect to any 3rd party algorithmic solution desired

- Seamless integration with any 3rd party solutions if needed

- The ability to run more than 100,000 symbols simultaneously

- Extensive user privilege capabilities

Supported Instruments

- Equities

- Futures Contracts

- Forex

- Derivatives

- ETFs

- Bonds and Sukuks

Improve Workflow

- Automated, Semi-Automated or Manual activity workflows

- Dedicated Market Making dashboard with all functionality on one screen

- Automate workflow and risk management and hedging activity

- Market condition based triggers to allow for various algorithms/strategies depending on actual realized volatility and volume

- Integrated with ZagTrader EMS, OMS, Clearing & Settlement system or a stand-alone solution that can be integrated with existing systems

Manage Risk & Compliance

- Real-time position, P&L, exposure, un-hedged exposure and VaR data

- Real-time alerts on thresholds, limits and activity

- Audit trail and regulatory reporting of presence, max-spread, bid/ask size

- AI analytical tools for back testing and forward testing

Connectivity

- Connectivity to hundreds of exchanges worldwide

- Connectivity to global routing networks (Bloomberg, Reuters, NYSE)

- Solution requires in-bound Data Feed connection (available from ZagTrader); and out-bound FIX connection for order routing to the Exchange/Clearing Member

For a complete list of ZagTrader's Global Features

Please Click Here