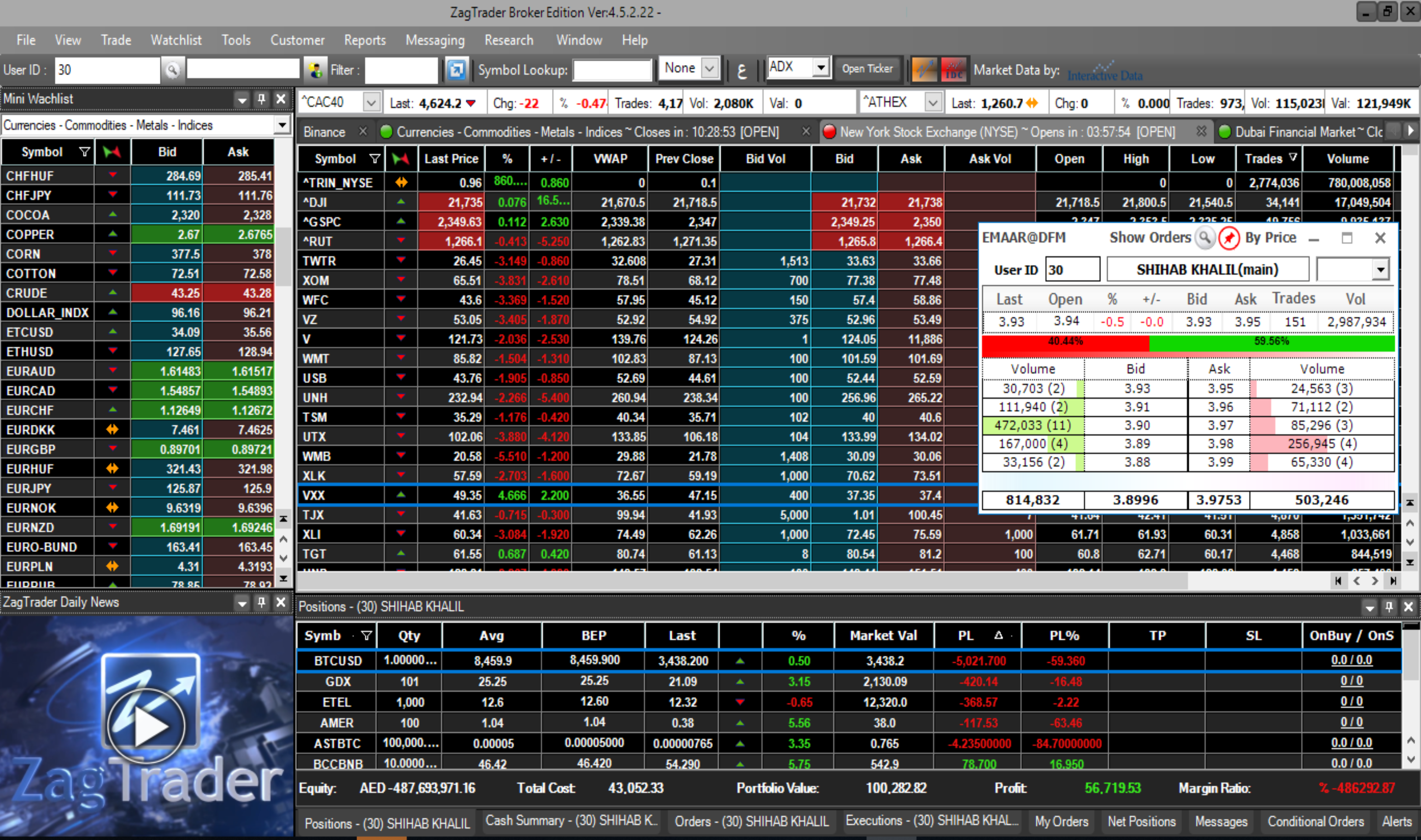

Efficient and effective investment administration platform

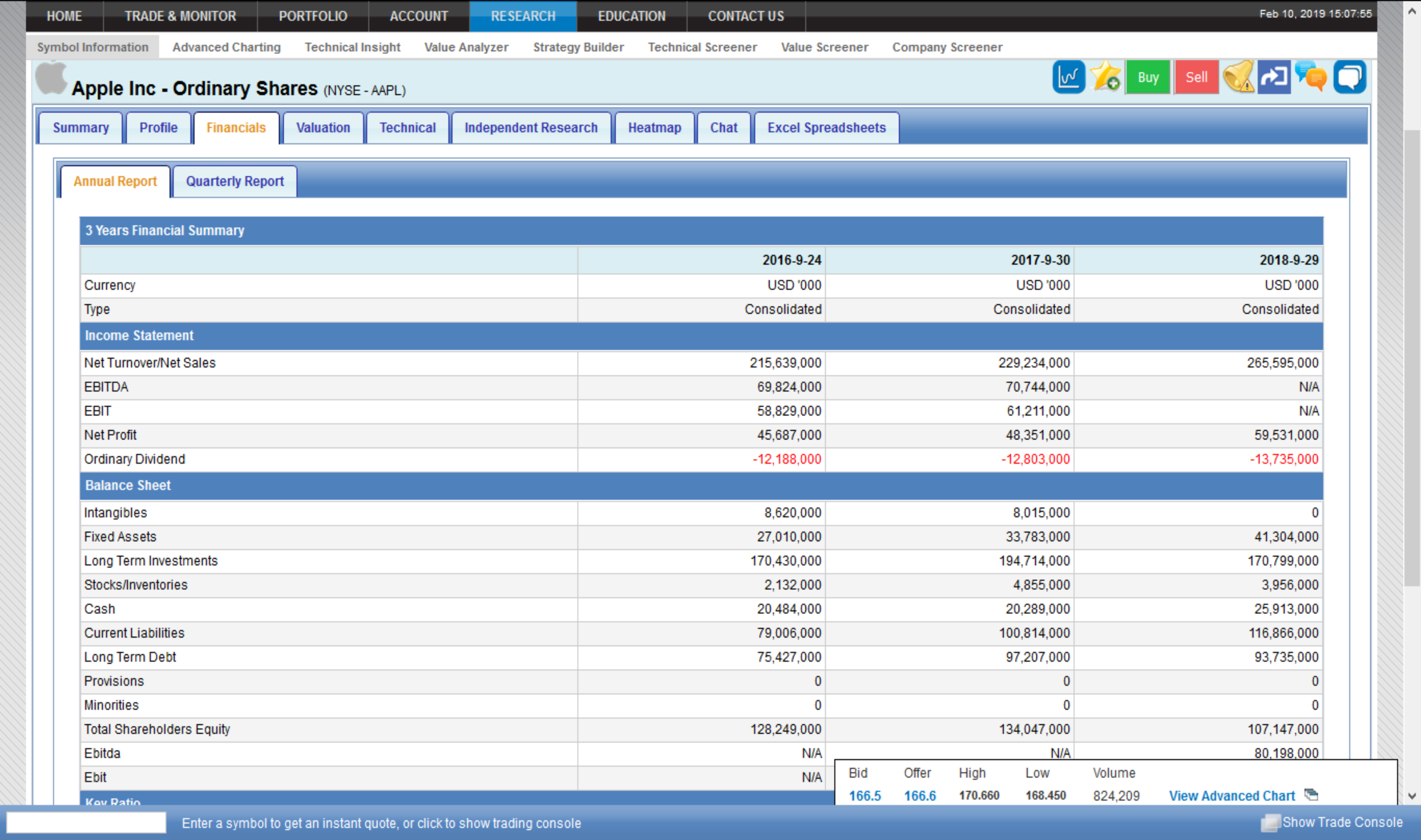

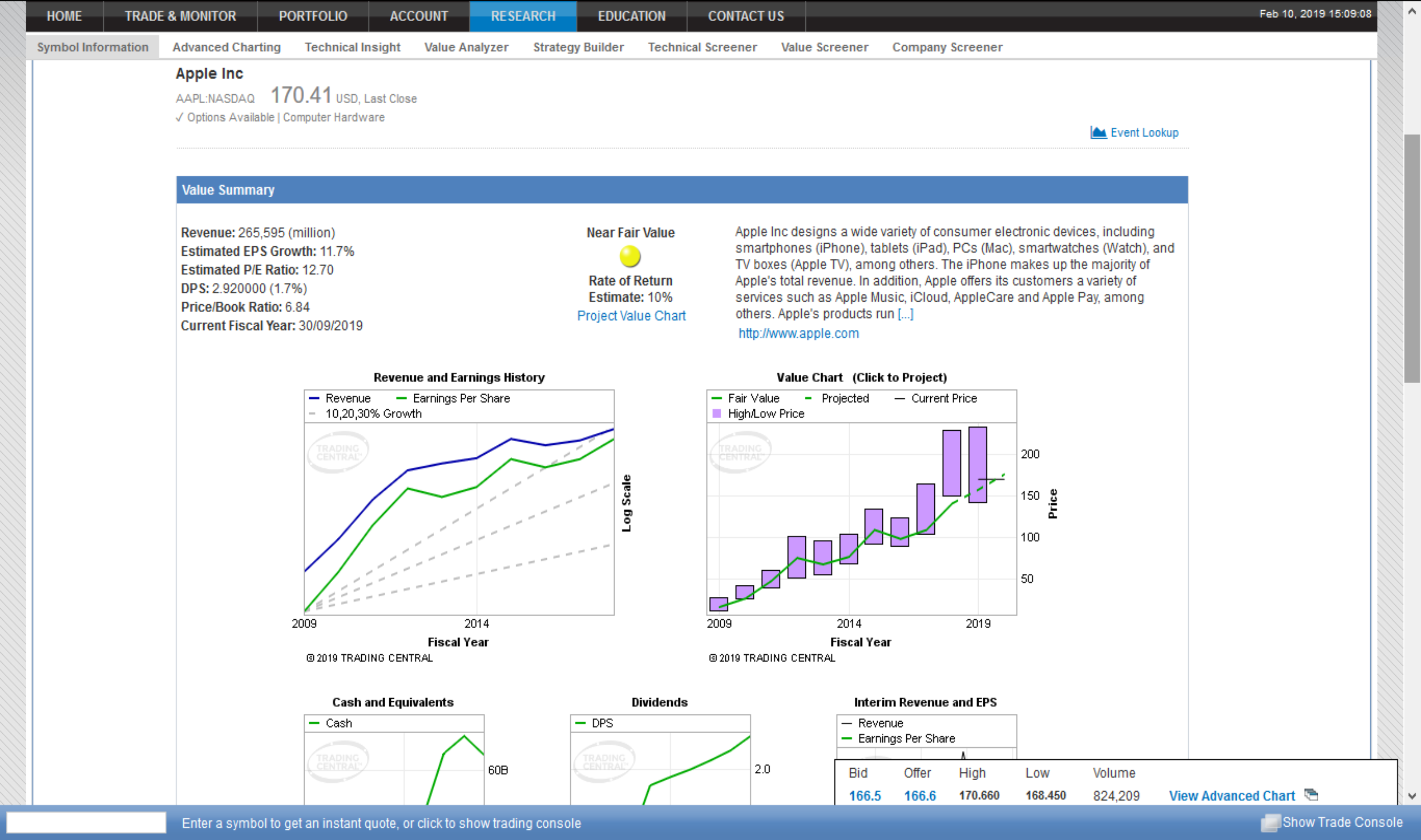

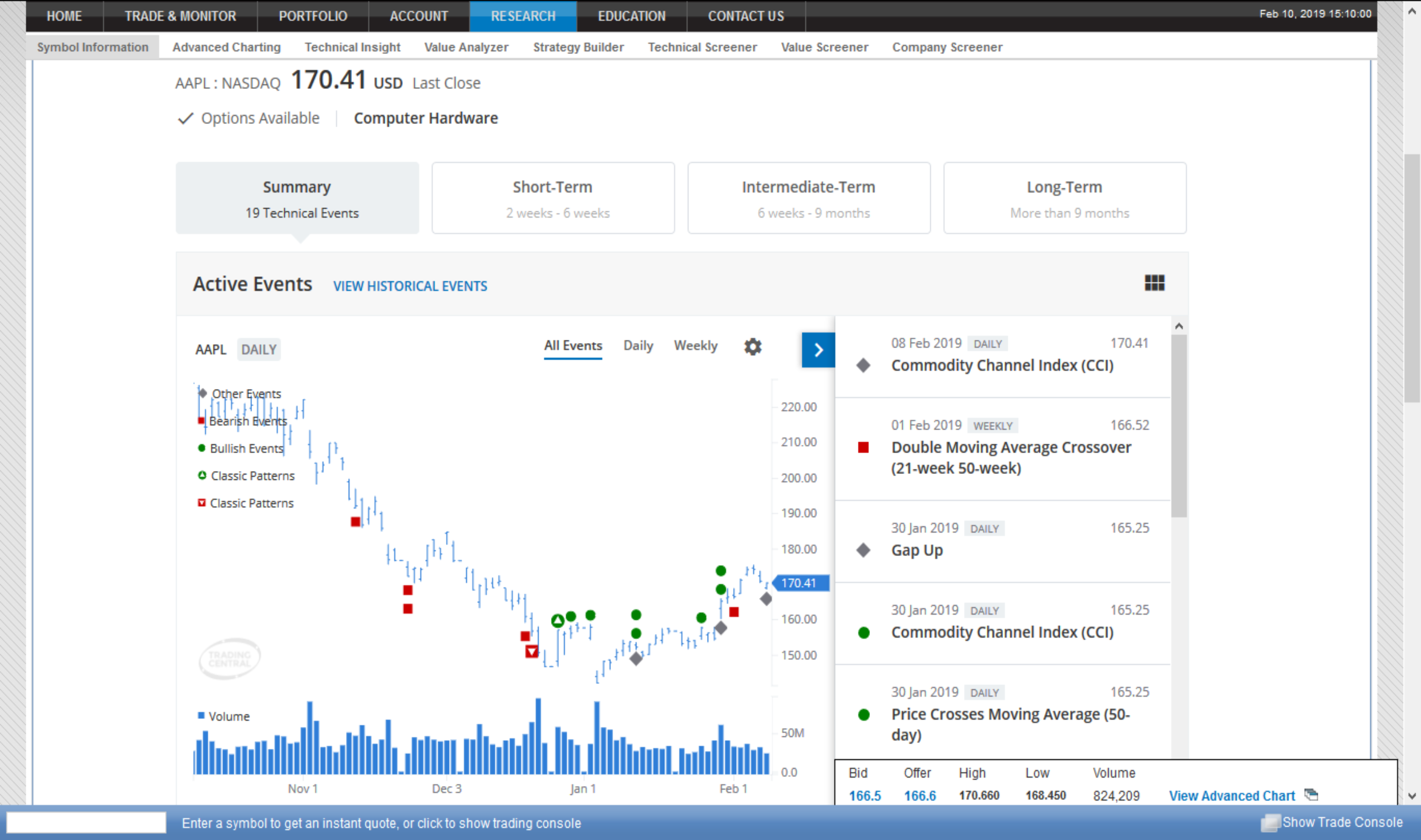

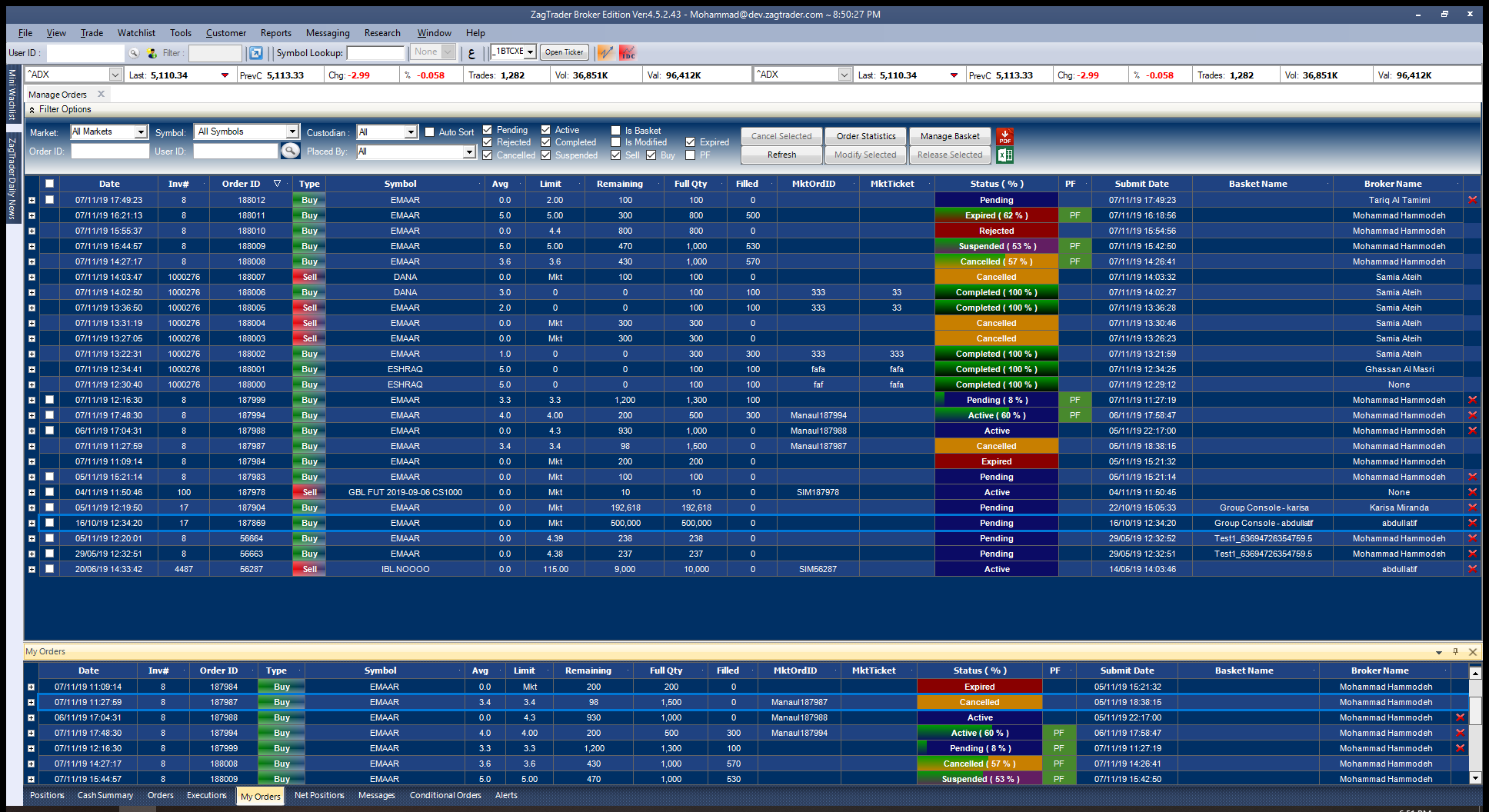

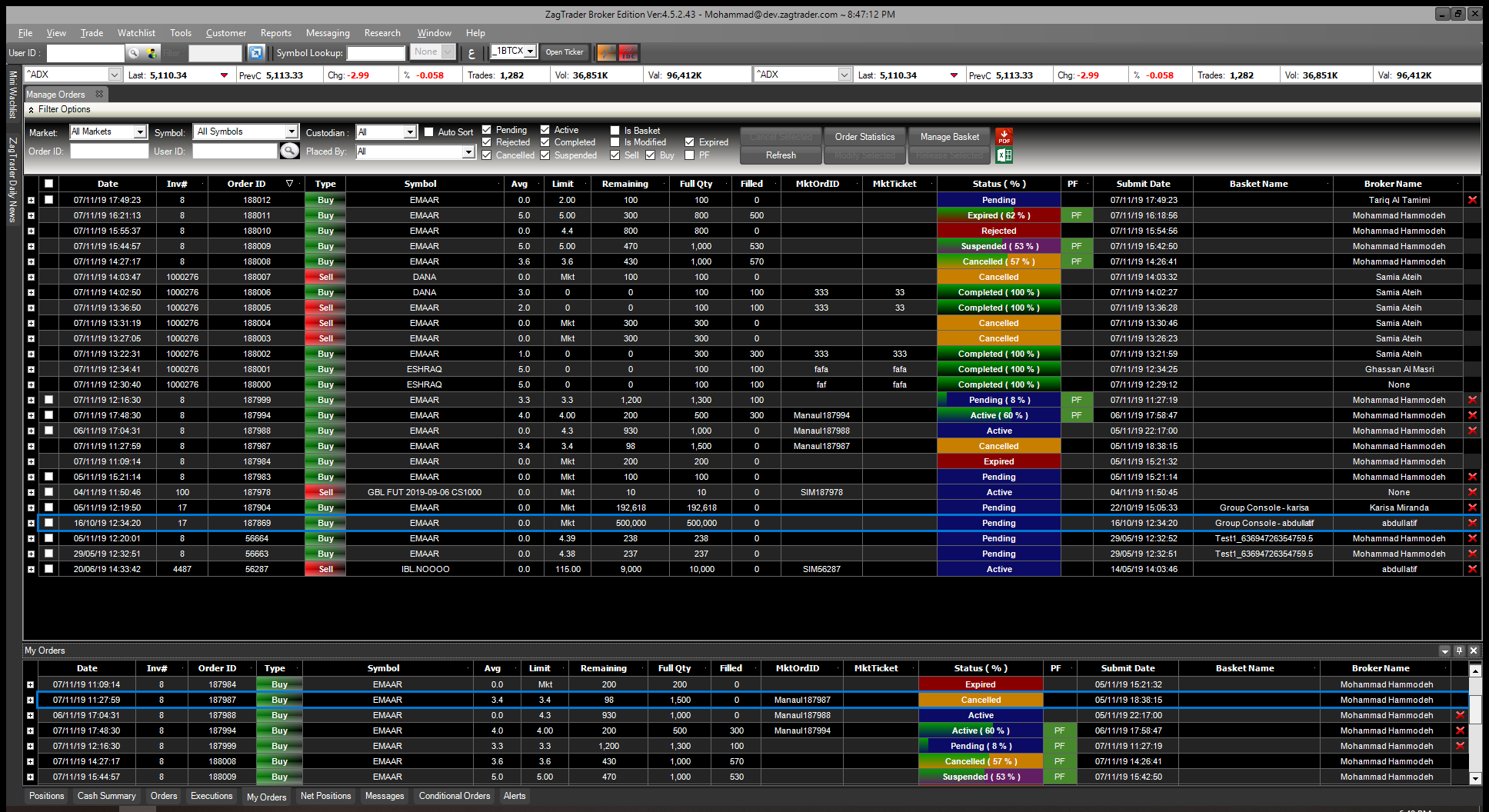

Back Office solution for discretionary and advisory managed accounts among many custodians, clearing agents and brokers for any financial instrument and an investment component. ZagTrader Investment Back Office platform is geared to meet the needs of niche as well as large Fund Managers, Wealth Management, Multi-Managers and Pension funds.

24x7 Real-time Transaction Processing

Main Features

- Investments accounting

- PnL calculation with several methodologies

- Maintenance of several managed accounts per customer account based on investment profile and strategy

- Mark-to-Market/Model valuation based on theoretical pricing models

- Transactions settlement process

- Reconciliation with custodians

- Analytical portfolios’ cash flows and cost analysis break-down

- Portfolio cash flow projections

- Corporate actions creation, maintenance and automatic processing

- Full Accounting and data entry with unlimited drill-downs

- Investment funding’s & cash positions

- Investor relations

- Document management and retention

- Capital calls/capital distributions

- Cash management

- Line of credit reporting

- Confirmations, statements and detailed profitability/exposure/expenses reports

- Collateral transactions

- Valuation and reconciliation

- Structured floating indices and amortization schedules for fixed-income securities/transactions

- Journal entries generation according to the company's accounting scheme

- Calculations of Fees and expenses

- Management, Custody and admin fee calculation

- Amortization of expenses using any type of cash flow schedule and manual adjustments

- Investor allocations

- Audit/tax process management

- Investment management systems

- Management fee calculations

- Incentive/performance fee calculations

- Subsequent closing computations

- Reporting of organizational / syndication costs

- Line of credit draws and payoffs

24 x7 Real-Time Transaction Processing

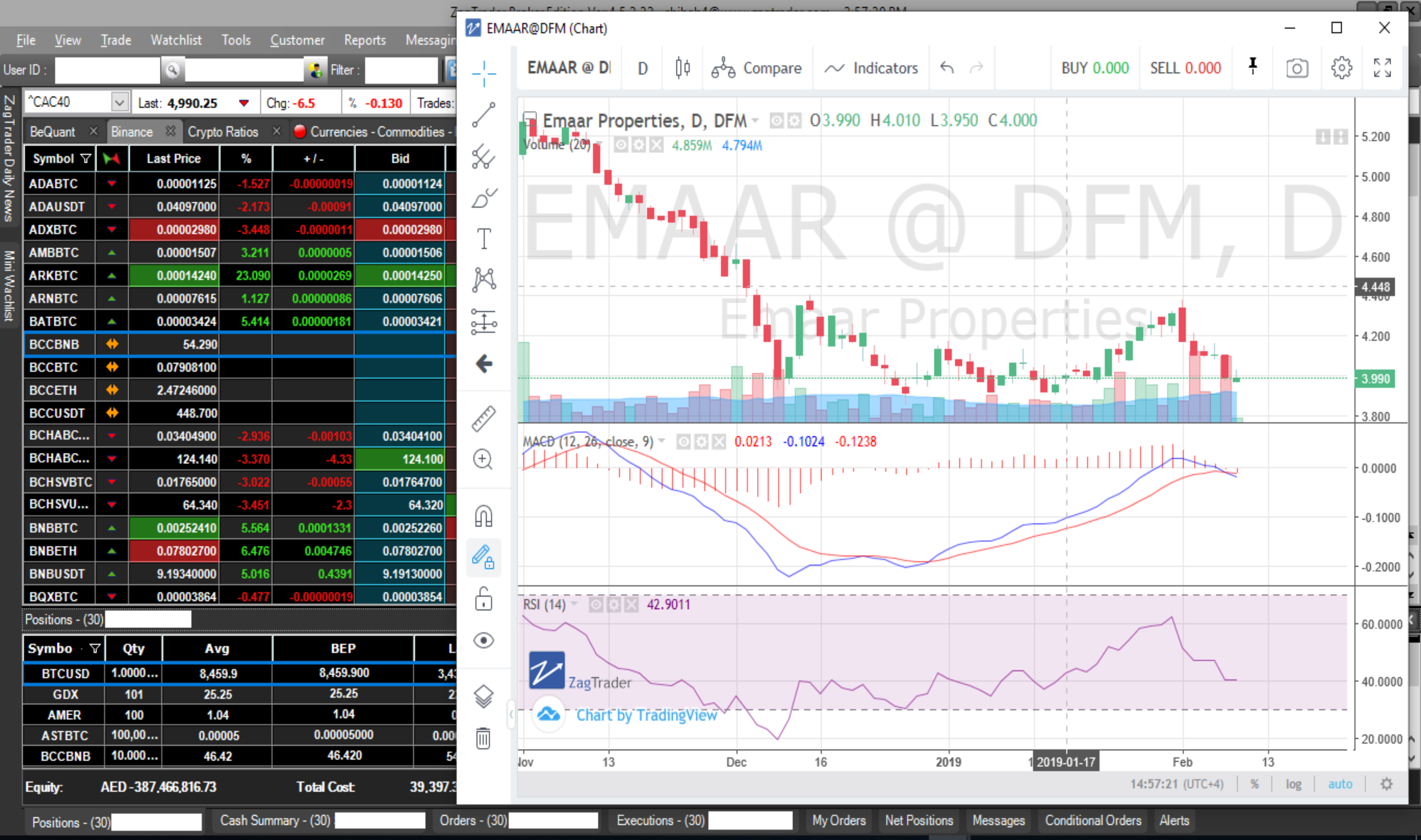

Graphical workflows & Unitized Pricing

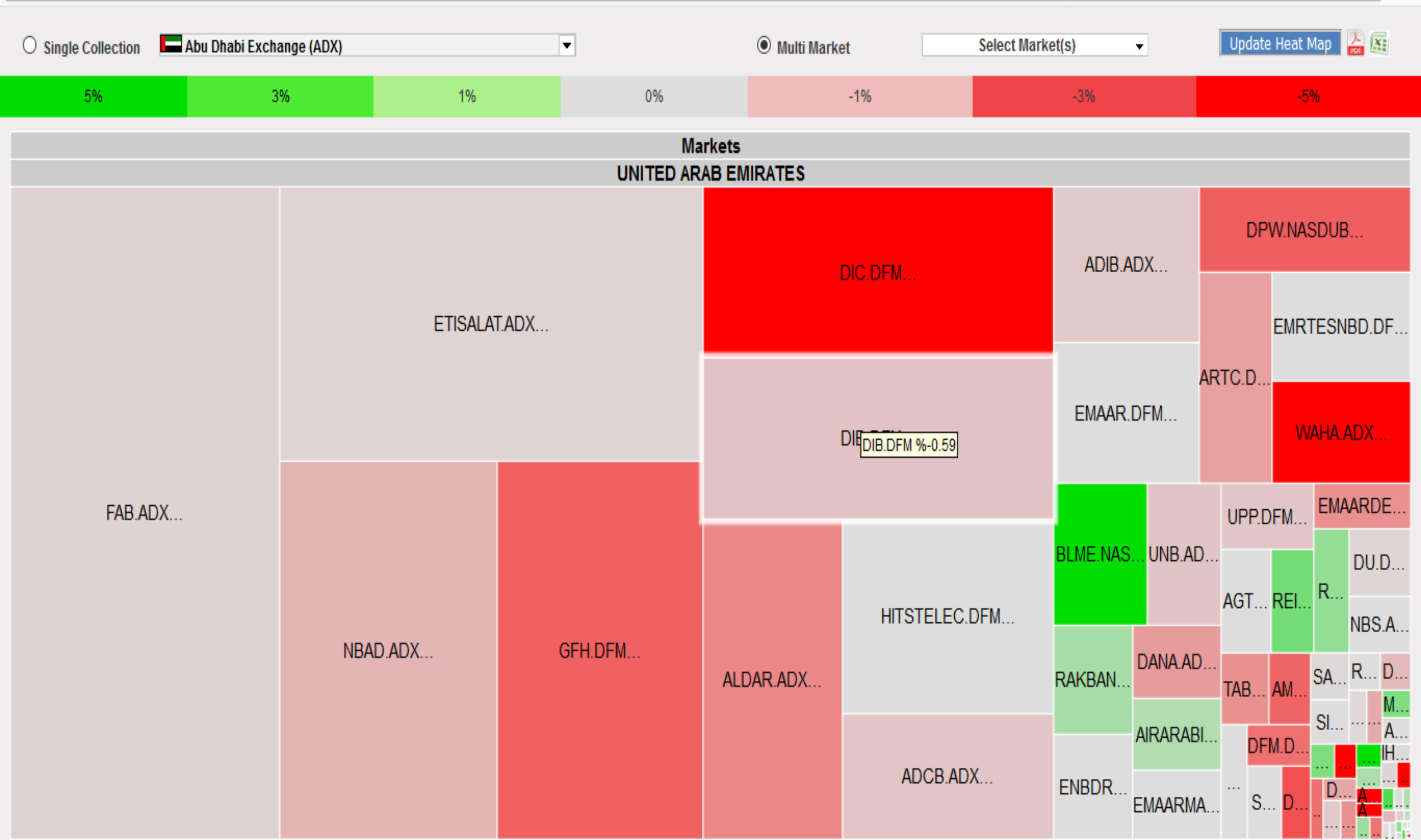

Industry Leading Solution

Transparency • Compliance • Risk Management

Multi-Asset. Multi-Currency. Multi-Lingual

Back Office and Back End Services

- Support for multiple Custodians, Brokers and fee structures

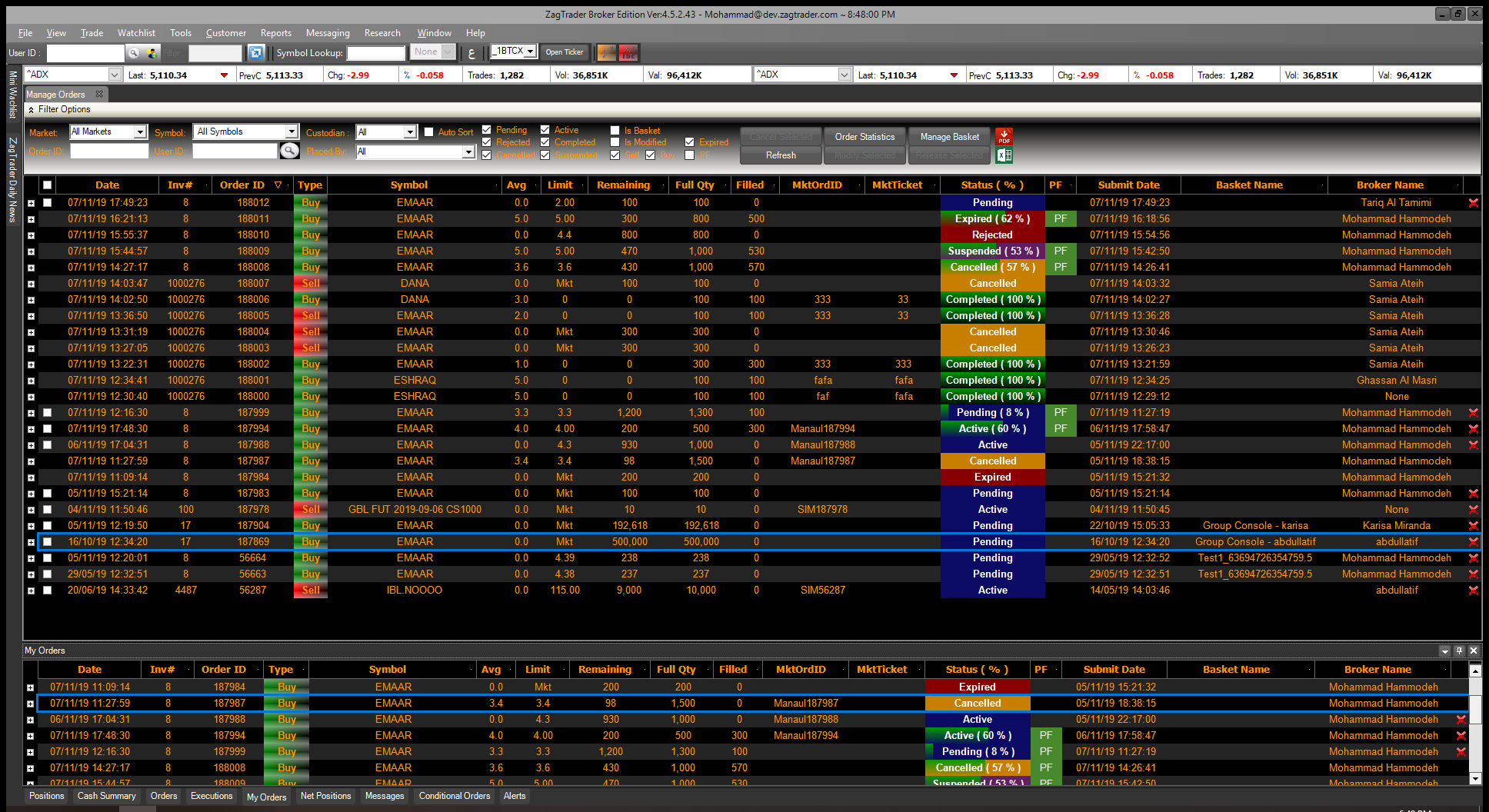

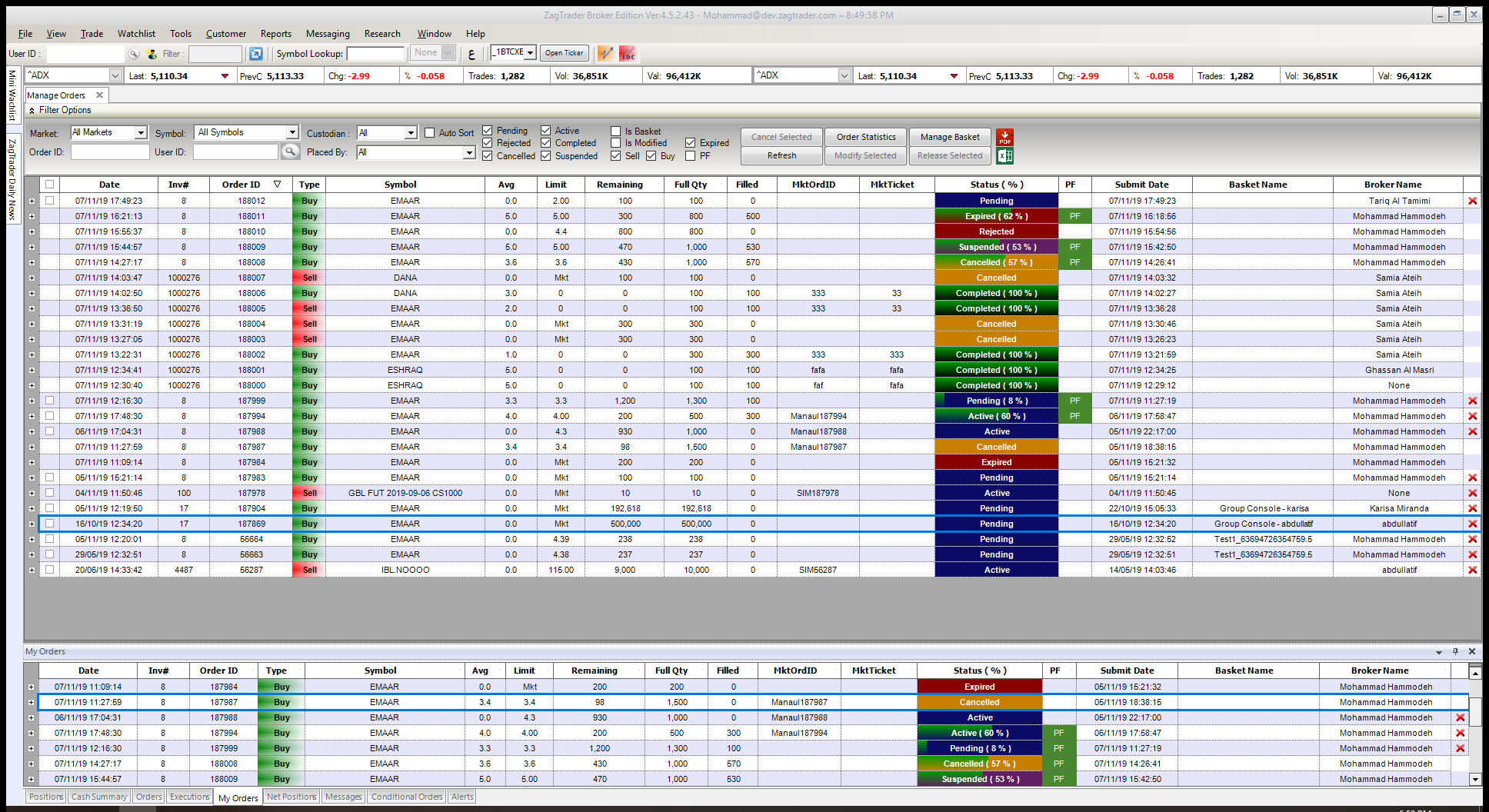

- Automated post-trade processing with exception management with user-defined settlement rules.

- Distribution of data to Portfolio Manager, Accounts and Family Office Clients

- Automated Trade confirmations, settlement instructions, post-trade matching, settlement and reconciliation

- Efficient and easy-to-use UI, dashboard and settings

- Automated reporting with custom reports in multiple file formats

- Managing your employees: Full privilege/permission system with complete automation of workflows and processes

- Reduced Risk and Manual Intervention: Automation of clients onboarding

- KYC & Document Management

- Capabilities to route your orders to multiple destinations

- Risk Management & Algorithmic Trading

- Mobilize your customers with white-labelled mobile and tablet apps to view and trade their portfolio in real-time with a fully white-labelled solution

- Expand business to millions of local customers and billions globally

Connectivity

- Scalable and service-driven architecture developed to provide reliable low-latency and high-throughput access across market conditions

- Direct to venue FIX connectivity for orders and/or price feed; External data/price feed connectivity options

- Connectivity to: AUTEX, EMSX, NYFIX, TSOX, Dark-pools, Prime brokers and any FIX-compliant destination

World at your Finger Tips

Mobile Application

Customers trade whenever and wherever

200+ Global Markets

Realtime Market Data Feeds. Buy / Sell in multiple market

Single Integrated Interface

All Departments connected under ONE System

Calculate Fees & Charges

Real time lien and calculation of fees and charges with complete audit and reporting

Connect Core Banking System in Realtime

Real time synchronization and access to core banking system

Scalable & Cost Effective

Introduce New Products Generate New streams of Income.

Bleed-edge End-to-end Integrated Technology

Desktop, Tablet and Mobile applications with 2FA enable traders the ability to constantly monitor and manage trading flow in a fully secure manner. FIX standardization and handlers to enable efficient and fast integration of new connections and improve the Client onboarding experience and support business demands.

Collaborate to Innovate with ZagTrader

For a complete list of ZagTrader's Global Features

Please Click Here